Question: please solve it as soon as undefined On January 1, 2014, Santo Company purchased a computer system for $30,500. The system had an estimated useful

please solve it as soon as

undefined

undefined

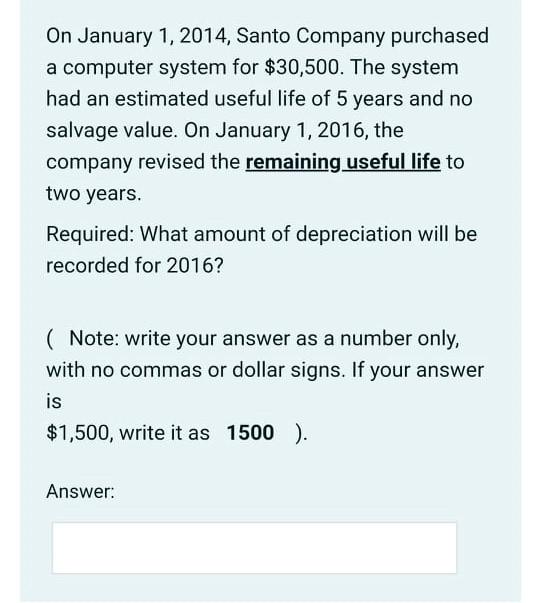

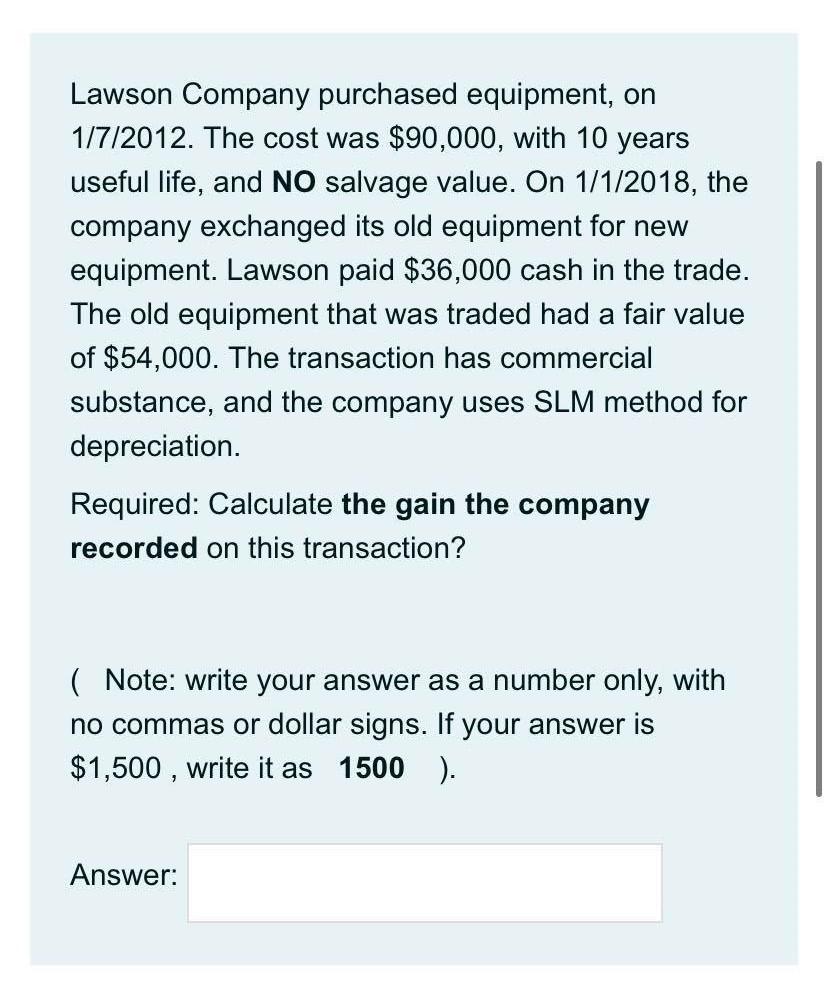

On January 1, 2014, Santo Company purchased a computer system for $30,500. The system had an estimated useful life of 5 years and no salvage value. On January 1, 2016, the company revised the remaining useful life to two years. Required: What amount of depreciation will be recorded for 2016? (Note: write your answer as a number only, with no commas or dollar signs. If your answer is $1,500, write it as 1500 ). Answer: Lawson Company purchased equipment, on 1/7/2012. The cost was $90,000, with 10 years useful life, and NO salvage value. On 1/1/2018, the company exchanged its old equipment for new equipment. Lawson paid $36,000 cash in the trade. The old equipment that was traded had a fair value of $54,000. The transaction has commercial substance, and the company uses SLM method for depreciation. Required: Calculate the gain the company recorded on this transaction? ( Note: write your answer as a number only, with no commas or dollar signs. If your answer is $1,500 , write it as 1500 ). er

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts