Question: please solve it ASAP I do not have much time Question 14 1 pts Consider three stocks A, B, and C for which you have

please solve it ASAP I do not have much time

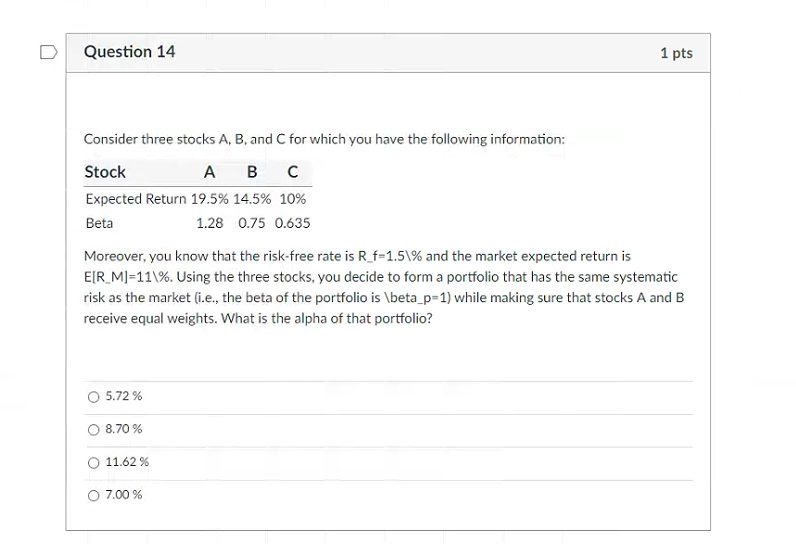

Question 14 1 pts Consider three stocks A, B, and C for which you have the following information: Stock Expected Return 19.5% 14.5% 10% Beta 1.28 0.75 0.635 Moreover, you know that the risk-free rate is R_f=1.5% and the market expected return is E[R_M]=11\%. Using the three stocks, you decide to form a portfolio that has the same systematic risk as the market (i.e., the beta of the portfolio is \beta_p=1) while making sure that stocks A and B receive equal weights. What is the alpha of that portfolio? O 5.72% 8.70 % 11.62 % 0 7.00 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts