Question: please solve it completely as soon as possible i. ii. iii. iv. On 15 July 2020, Grant met with his supervisor, and he was informed

please solve it completely as soon as possible

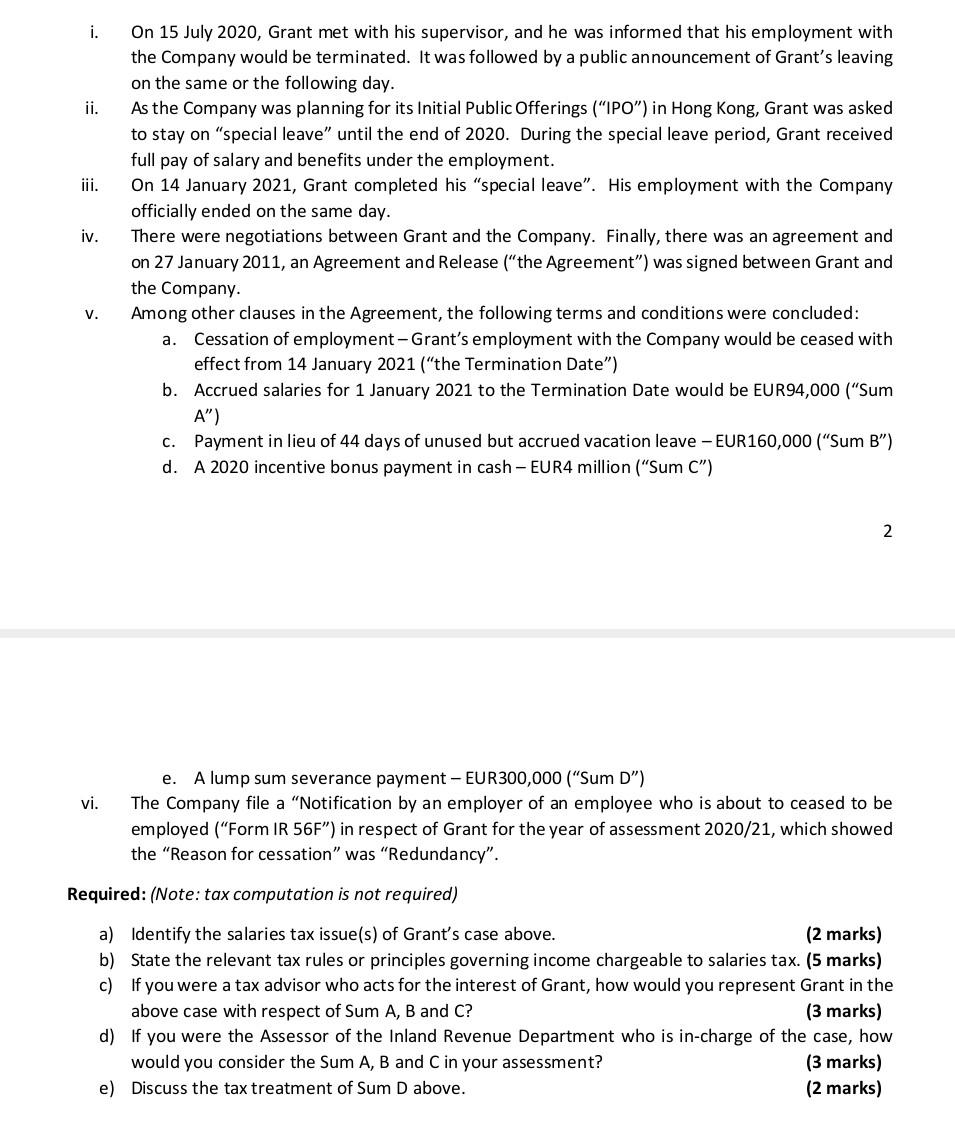

i. ii. iii. iv. On 15 July 2020, Grant met with his supervisor, and he was informed that his employment with the Company would be terminated. It was followed by a public announcement of Grant's leaving on the same or the following day. As the Company was planning for its Initial Public Offerings ("IPO") in Hong Kong, Grant was asked to stay on "special leave" until the end of 2020. During the special leave period, Grant received full pay of salary and benefits under the employment. On 14 January 2021, Grant completed his "special leave". His employment with the Company officially ended on the same day. There were negotiations between Grant and the Company. Finally, there was an agreement and on 27 January 2011, an Agreement and Release ("the Agreement") was signed between Grant and the Company. Among other clauses in the Agreement, the following terms and conditions were concluded: a. Cessation of employment - Grant's employment with the Company would be ceased with effect from 14 January 2021 ("the Termination Date") b. Accrued salaries for 1 January 2021 to the Termination Date would be EUR 94,000 ("Sum A") C. Payment in lieu of 44 days of unused but accrued vacation leave - EUR160,000 ("Sum B") d. A 2020 incentive bonus payment in cash - EUR4 million ("Sum C") V. 2 e. vi. A lump sum severance payment - EUR 300,000 ("Sum D") The Company file a "Notification by an employer of an employee who is about to ceased to be employed ("Form IR 56F") in respect of Grant for the year of assessment 2020/21, which showed the "Reason for cessation" was "Redundancy". Required: (Note: tax computation is not required) a) Identify the salaries tax issue(s) of Grant's case above. (2 marks) b) State the relevant tax rules or principles governing income chargeable to salaries tax. (5 marks) c) If you were a tax advisor who acts for the interest of Grant, how would you represent Grant in the above case with respect of Sum A, B and C? (3 marks) d) If you were the Assessor of the Inland Revenue Department who is in-charge of the case, how would you consider the Sum A, B and C in your assessment? (3 marks) e) Discuss the tax treatment of Sum D above. (2 marks) i. ii. iii. iv. On 15 July 2020, Grant met with his supervisor, and he was informed that his employment with the Company would be terminated. It was followed by a public announcement of Grant's leaving on the same or the following day. As the Company was planning for its Initial Public Offerings ("IPO") in Hong Kong, Grant was asked to stay on "special leave" until the end of 2020. During the special leave period, Grant received full pay of salary and benefits under the employment. On 14 January 2021, Grant completed his "special leave". His employment with the Company officially ended on the same day. There were negotiations between Grant and the Company. Finally, there was an agreement and on 27 January 2011, an Agreement and Release ("the Agreement") was signed between Grant and the Company. Among other clauses in the Agreement, the following terms and conditions were concluded: a. Cessation of employment - Grant's employment with the Company would be ceased with effect from 14 January 2021 ("the Termination Date") b. Accrued salaries for 1 January 2021 to the Termination Date would be EUR 94,000 ("Sum A") C. Payment in lieu of 44 days of unused but accrued vacation leave - EUR160,000 ("Sum B") d. A 2020 incentive bonus payment in cash - EUR4 million ("Sum C") V. 2 e. vi. A lump sum severance payment - EUR 300,000 ("Sum D") The Company file a "Notification by an employer of an employee who is about to ceased to be employed ("Form IR 56F") in respect of Grant for the year of assessment 2020/21, which showed the "Reason for cessation" was "Redundancy". Required: (Note: tax computation is not required) a) Identify the salaries tax issue(s) of Grant's case above. (2 marks) b) State the relevant tax rules or principles governing income chargeable to salaries tax. (5 marks) c) If you were a tax advisor who acts for the interest of Grant, how would you represent Grant in the above case with respect of Sum A, B and C? (3 marks) d) If you were the Assessor of the Inland Revenue Department who is in-charge of the case, how would you consider the Sum A, B and C in your assessment? (3 marks) e) Discuss the tax treatment of Sum D above. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts