Question: please solve it completly and correctly using same given values. thanks. 5. A General Motors Bond carries a coupon rate of 8%, has 9 years

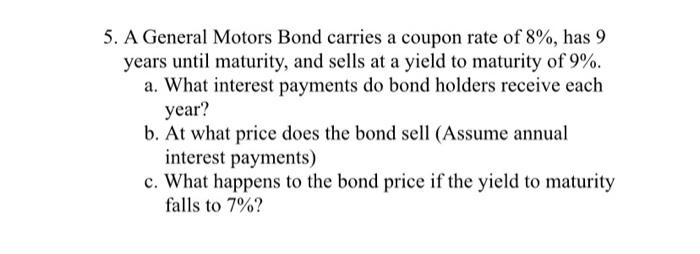

5. A General Motors Bond carries a coupon rate of 8%, has 9 years until maturity, and sells at a yield to maturity of 9%. a. What interest payments do bond holders receive each year? b. At what price does the bond sell (Assume annual interest payments) c. What happens to the bond price if the yield to maturity falls to 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts