Question: please solve it fast ASAP with all requirements please don't do half and correct. i have not much time Chap 16 Please show your calculations

please solve it fast ASAP with all requirements please don't do half and correct. i have not much time

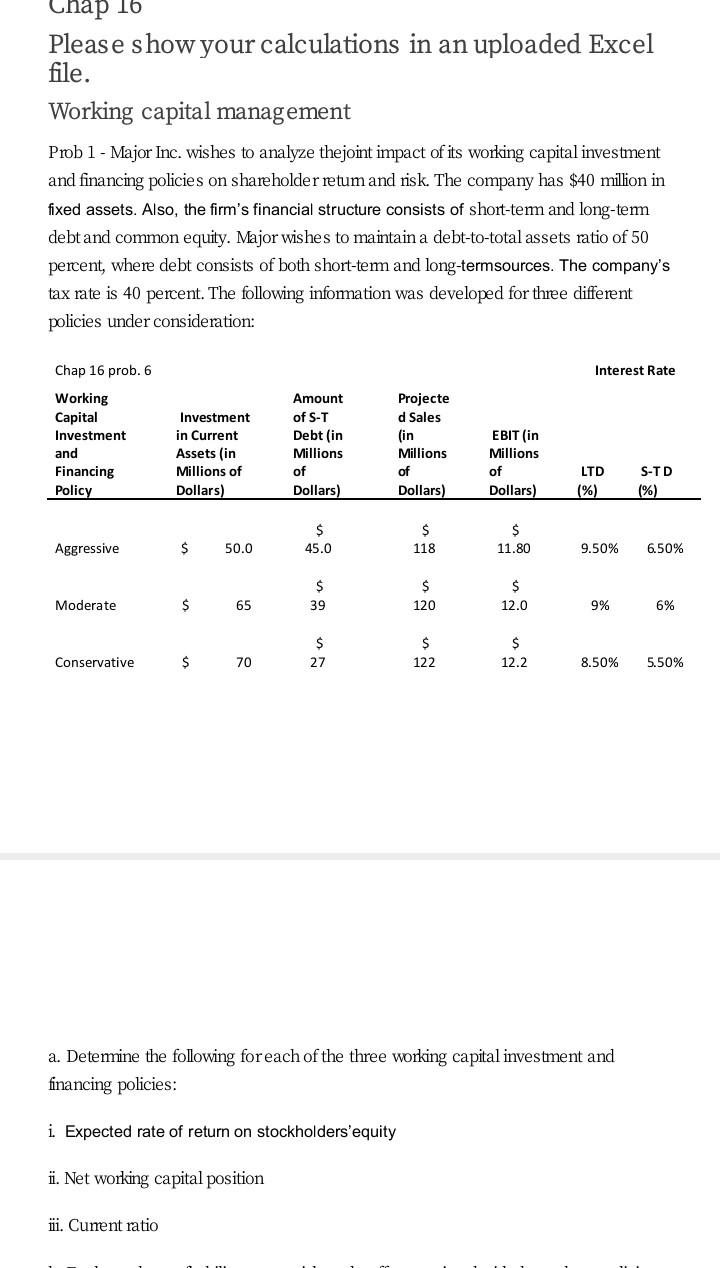

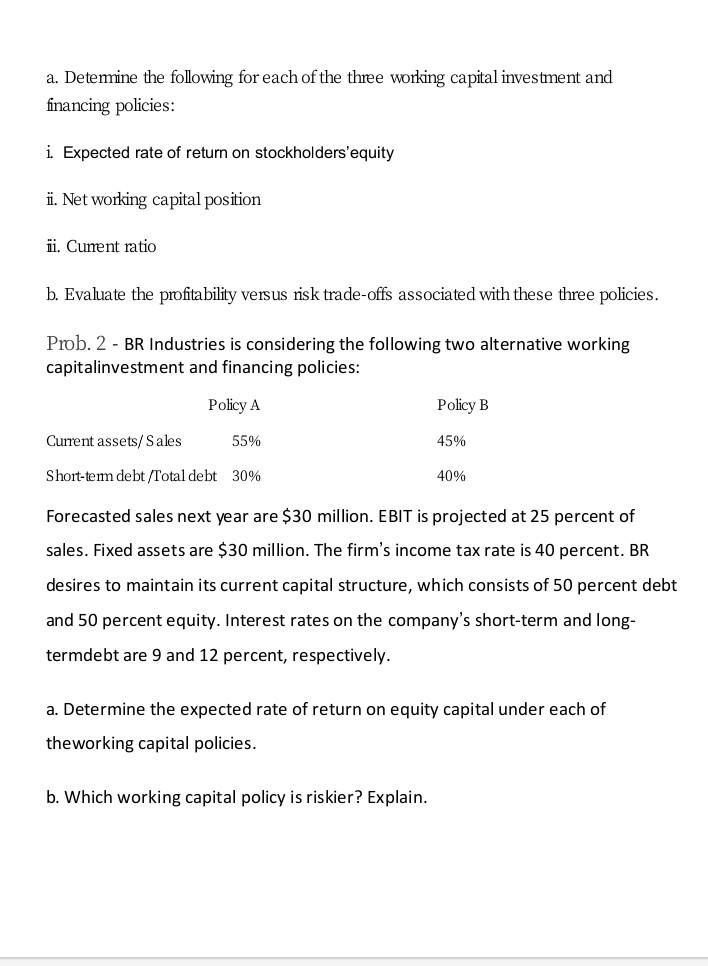

Chap 16 Please show your calculations in an uploaded Excel file. Working capital management Prob 1 - Major Inc. wishes to analyze thejoint impact of its working capital investment and financing policies on shareholder retum and risk. The company has $40 million in fixed assets. Also, the firm's financial structure consists of short-tem and long-tem debt and common equity. Major wishes to maintain a debt-to-total assets ratio of 50 percent, where debt consists of both short-term and long-termsources. The company's tax rate is 40 percent. The following information was developed for three different policies under consideration: Chap 16 prob. 6 Interest Rate Working Capital Investment and Financing Policy Investment in Current Assets (in Millions of Dollars) Amount of S-T Debt (in Millions of Dollars) Projecte d Sales (in Millions of Dollars) EBIT in Millions of Dollars) LTD (%) S-TD (%) $ 45.0 $ 118 Aggressive $ $ 11.80 50.0 9.50% 6.50% $ 39 $ 120 $ 12.0 Moderate $ 65 9% 6% $ $ 122 $ 12.2 Conservative $ 70 27 8.50% 5.50% a. Determine the following for each of the three working capital investment and financing policies: i. Expected rate of return on stockholders'equity . Net working capital position iii. Curent ratio a. Determine the following for each of the three working capital investment and financing policies: i. Expected rate of return on stockholders'equity ii. Net working capital position ii. Cument ratio b. Evaluate the profitability versus risk trade-offs associated with these three policies. Prob. 2 - BR Industries is considering the following two alternative working capitalinvestment and financing policies: Policy A Policy B Current assets/ Sales 55% 45% Short-term debt/Total debt 30% 40% Forecasted sales next year are $30 million. EBIT is projected at 25 percent of sales. Fixed assets are $30 million. The firm's income tax rate is 40 percent. BR desires to maintain its current capital structure, which consists of 50 percent debt and 50 percent equity. Interest rates on the company's short-term and long- termdebt are 9 and 12 percent, respectively. a. Determine the expected rate of return on equity capital under each of the working capital policies. b. Which working capital policy is riskier? Explain. Chap 16 Please show your calculations in an uploaded Excel file. Working capital management Prob 1 - Major Inc. wishes to analyze thejoint impact of its working capital investment and financing policies on shareholder retum and risk. The company has $40 million in fixed assets. Also, the firm's financial structure consists of short-tem and long-tem debt and common equity. Major wishes to maintain a debt-to-total assets ratio of 50 percent, where debt consists of both short-term and long-termsources. The company's tax rate is 40 percent. The following information was developed for three different policies under consideration: Chap 16 prob. 6 Interest Rate Working Capital Investment and Financing Policy Investment in Current Assets (in Millions of Dollars) Amount of S-T Debt (in Millions of Dollars) Projecte d Sales (in Millions of Dollars) EBIT in Millions of Dollars) LTD (%) S-TD (%) $ 45.0 $ 118 Aggressive $ $ 11.80 50.0 9.50% 6.50% $ 39 $ 120 $ 12.0 Moderate $ 65 9% 6% $ $ 122 $ 12.2 Conservative $ 70 27 8.50% 5.50% a. Determine the following for each of the three working capital investment and financing policies: i. Expected rate of return on stockholders'equity . Net working capital position iii. Curent ratio a. Determine the following for each of the three working capital investment and financing policies: i. Expected rate of return on stockholders'equity ii. Net working capital position ii. Cument ratio b. Evaluate the profitability versus risk trade-offs associated with these three policies. Prob. 2 - BR Industries is considering the following two alternative working capitalinvestment and financing policies: Policy A Policy B Current assets/ Sales 55% 45% Short-term debt/Total debt 30% 40% Forecasted sales next year are $30 million. EBIT is projected at 25 percent of sales. Fixed assets are $30 million. The firm's income tax rate is 40 percent. BR desires to maintain its current capital structure, which consists of 50 percent debt and 50 percent equity. Interest rates on the company's short-term and long- termdebt are 9 and 12 percent, respectively. a. Determine the expected rate of return on equity capital under each of the working capital policies. b. Which working capital policy is riskier? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts