Question: Please solve it fast for a thumbs up! The comparative balance sheet for Sandhill Adventures Ltd., a private company reporting under ASPE, follows: SANDHILL ADVENTURES

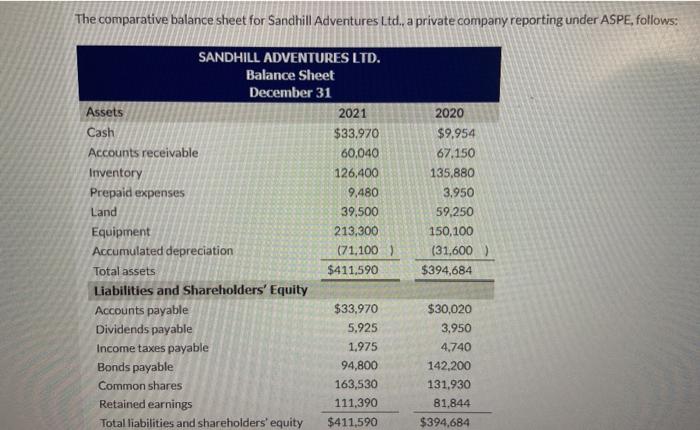

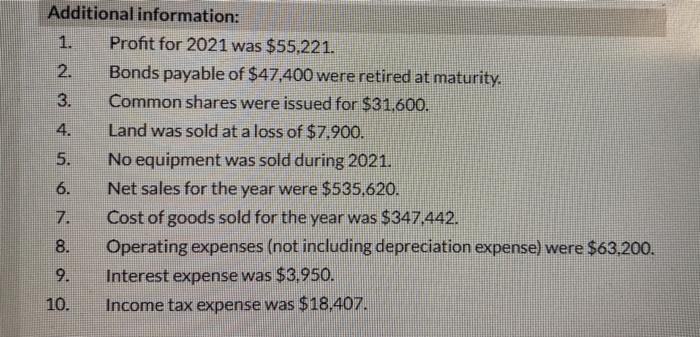

The comparative balance sheet for Sandhill Adventures Ltd., a private company reporting under ASPE, follows: SANDHILL ADVENTURES LTD. Balance Sheet December 31 Assets 2021 Cash $33.970 Accounts receivable 60,040 Inventory 126,400 Prepaid expenses 9,480 Land 39,500 Equipment 213,300 Accumulated depreciation (71.100) Total assets $411.590 Liabilities and Shareholders' Equity Accounts payable $33,970 Dividends payable 5.925 Income taxes payable 1,975 Bonds payable 94,800 Common shares 163,530 Retained earnings 111,390 Total liabilities and shareholders' equity $411,590 2020 $9,954 67,150 135,880 3.950 59.250 150,100 (31,600 $394,684 $30,020 3,950 4,740 142,200 131,930 81.844 $394,684 Additional information: Profit for 2021 was $55.221. 2. Bonds payable of $47,400 were retired at maturity. 3. Common shares were issued for $31.600. 4. Land was sold at a loss of $7.900. 5. No equipment was sold during 2021. 6. Net sales for the year were $535.620. 7. Cost of goods sold for the year was $347.442. 8. Operating expenses (not including depreciation expense) were $63,200. 9. Interest expense was $3.950. 10. Income tax expense was $18.407. Prepare a cash flow statement using the indirect method. (Show amounts that decrease cash flow with either a-signes. -15,000 or in parenthesis eg. (15,000)) SANDHILL ADVENTURES LTD. Cash Flow Statement-Indirect Method Adjustments to reconcile profit to ( ( A M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts