Question: please solve it fast with in 2 hours i need urgent Question 8 Answer All parts of this Question. (a) This part of the Question

please solve it fast with in 2 hours i need urgent

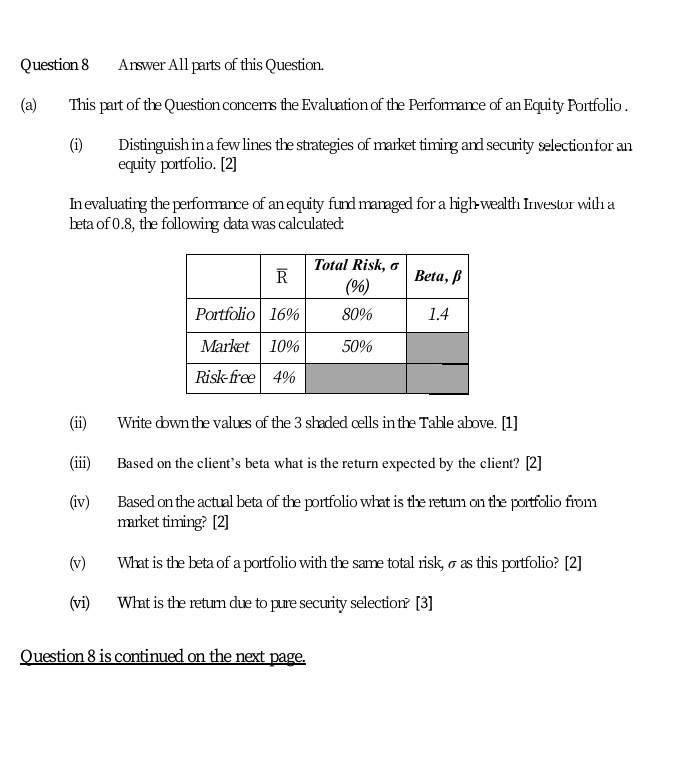

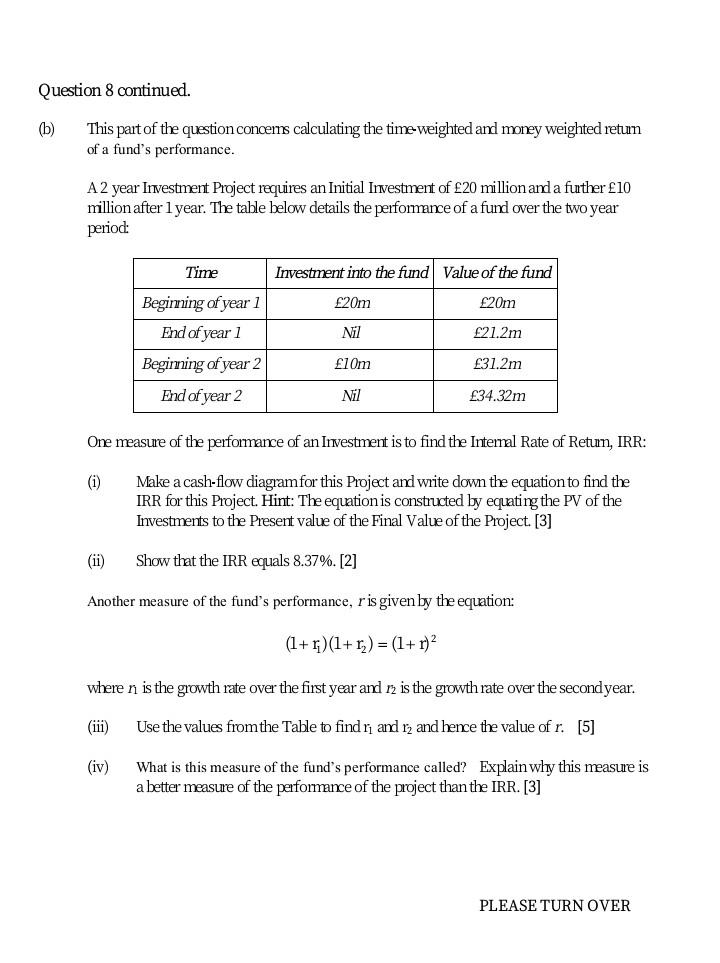

Question 8 Answer All parts of this Question. (a) This part of the Question concerns the Evaluation of the Performance of an Equity Portfolio. (1) Distinguish in a few lines the strategies of market timing and security selection for an equity portfolio. [2] In evaluating the performance of an equity fund managed for a high wealth Irivestor with a beta of 0.8, the following data was calculated: R Total Risk, o (%) Beta, 80% 1.4 Portfolio 16% Market 10% Risk-free 4% 50% (ii) Write down the values of the 3 shaded cells in the Table above. [1] (iv) Based on the client's beta what is the return expected by the client? [2] Based on the actual beta of the portfolio what is the return on the portfolio fiom market timing? [2] v) What is the beta of a portfolio with the same total risk, o as this portfolio? [2] (vi) What is the return due to pure security selection [3] Question 8 is continued on the next page. Question 8 continued. (b) This part of the question concems calculating the time weighted and money weighted retum of a fund's performance. A2 year Investment Project requires an Initial Investment of 20 million and a futher 10 million after 1 year. The table below details the performance of a fund over the two year period: Time Investment into the fund Value of the fund 20m 20m Nil 21.2m Beginning of year 1 End of year 1 Beginning of year 2 End of year 2 10m 31.2m Nil 34.32m One measure of the performance of an Investment is to find the Internal Rate of Return, IRR: (i) Make a cash-flow diagram for this project and write down the equation to find the IRR for this project. Hint: The equation is constructed by equating the PV of the Investments to the Present value of the Final Value of the Project. [3] Show that the IRR equals 8.37%. [2] Another measure of the fund's performance, ris given by the equation: (1+1)(1+r) = (1+r) where n is the growth rate over the first year and n is the growth rate over the second year. Use the values from the Table to find ri and 12 and hence the value of r. [5] (iv) What is this measure of the fund's performance called? Explain why this measure is a better measure of the performance of the project than the IRR. [3] PLEASE TURN OVER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts