Question: please solve it fast with in 2 hours i need urgent please all requirements with working Question 1 On the 20th March, 2019 the following

please solve it fast with in 2 hours i need urgent

please all requirements with working

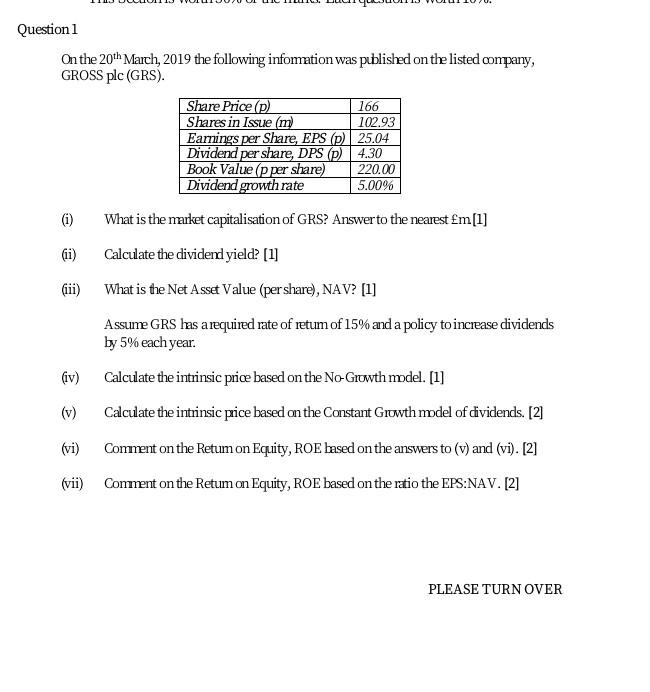

Question 1 On the 20th March, 2019 the following information was published on the listed company, GROSS plc (GRS). Share Price (p) 166 Shares in Issue (m) 102.93 Earnings per Share, EPS (p) 25.04 Dividend per share, DPS (p) 4.30 Book Value (p per share) 220.00 Dividend growth rate 5.00% (1) (ii) (iii) What is the market capitalisation of GRS? Answer to the nearest m[1] Calculate the dividend yield? [1] What is the Net Asset Value (per share), NAV? [1] Assume GRS has a required rate of retum of 15% and a policy to increase dividends by 5% each year. Calculate the intrinsic price based on the No-Growth model. [1] Calculate the intrinsic price based on the Constant Growth model of dividends. [2] Comment on the Retum on Equity, ROE based on the answers to (v) and (vi). [2] (iv) (v) (vi) (vii) Comment on the Retum on Equity, ROE based on the ratio the EPS:NAV. [2] PLEASE TURN OVER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts