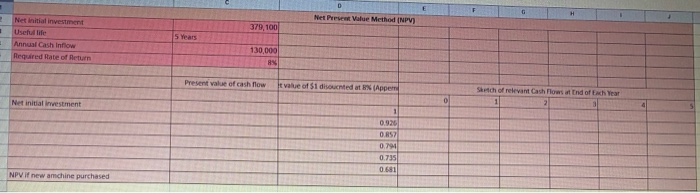

Question: please solve it fastly and correctly thanks for the help Net Present Value Method (NPV) 379,100 1 Net initial investment Useful life Annual Cash Innow

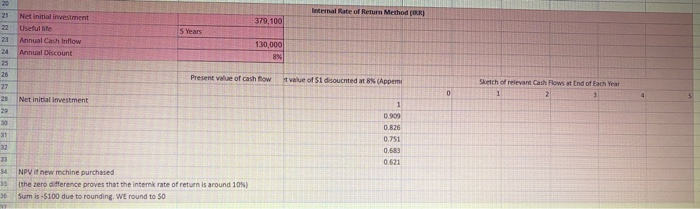

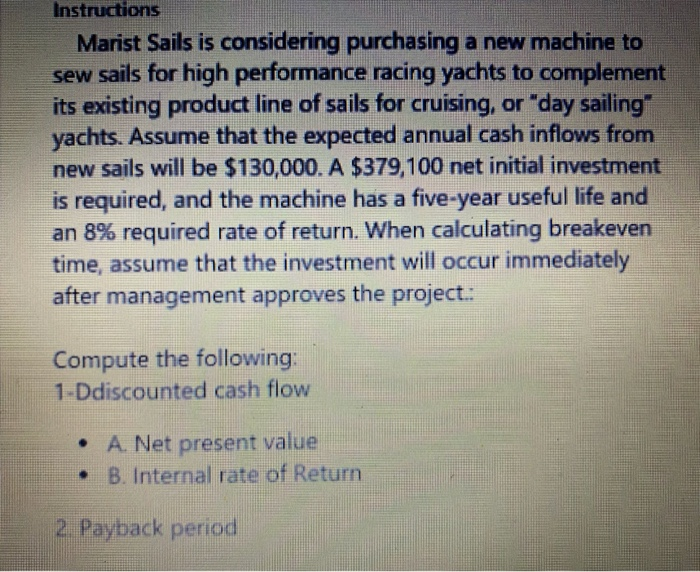

Net Present Value Method (NPV) 379,100 1 Net initial investment Useful life Annual Cash Innow Required Rate of Return 5 Years 130,000 8 Present value of cash flow I value of $1 disorted at (Appem Sketch of relevant Cash Flows and of Each Year Net initial investment 0 0.926 0.52 0.794 0.735 0.681 NPV if new amchine purchased Internal Rate of Return Method (IRR) 23 22 379,100 Net initial investment Useful life Annual Cash Inflow Annual Discount 5 Years 23 130,000 8% 24 25 26 Present value of cash flow t value of S1 disoucnted at Appem Sketch of relevant Cash Flows at End of Each Year 1 0 25 Net initial investment 30 31 1 0.900 0.826 0.751 0.583 0.621 32 33 34 35 NPV it new mchine purchased (the zero difference proves that the interk rate of return is around 10%) Sum is-S100 due to rounding. WE round to so 2 Payback Method 3 Payback=(Net initial investment)/Increase in cash flow 4 5 Instructions Marist Sails is considering purchasing a new machine to sew sails for high performance racing yachts to complement its existing product line of sails for cruising, or "day sailing" yachts. Assume that the expected annual cash inflows from new sails will be $130,000. A $379,100 net initial investment is required, and the machine has a five-year useful life and an 8% required rate of return. When calculating breakeven time, assume that the investment will occur immediately after management approves the project: Compute the following: 1-Ddiscounted cash flow A. Net present value B. Internal rate of Return 2 Payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts