Question: Please solve it. Humble request Q.2 Use the below Balance Sheet for Master Bank Ltd to answer the questions Amount Duration (Rs) (Years) Loans Floating

Please solve it. Humble request

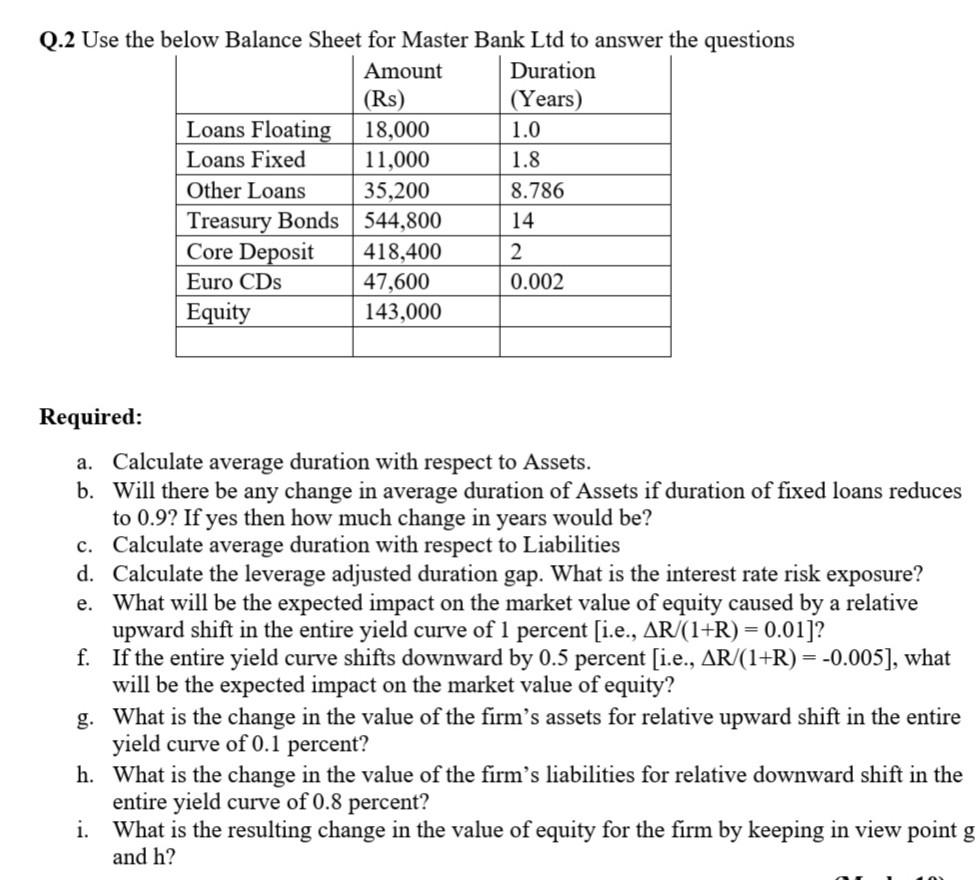

Q.2 Use the below Balance Sheet for Master Bank Ltd to answer the questions Amount Duration (Rs) (Years) Loans Floating 18,000 1.0 Loans Fixed 11,000 1.8 Other Loans 35,200 8.786 Treasury Bonds 544,800 14 Core Deposit 418,400 2 Euro CDs 47,600 0.002 Equity 143,000 Required: a. Calculate average duration with respect to Assets. b. Will there be any change in average duration of Assets if duration of fixed loans reduces to 0.9? If yes then how much change in years would be? C. Calculate average duration with respect to Liabilities d. Calculate the leverage adjusted duration gap. What is the interest rate risk exposure? e. What will be the expected impact on the market value of equity caused by a relative upward shift in the entire yield curve of 1 percent [i.e., AR/(1+R) = 0.01]? f. If the entire yield curve shifts downward by 0.5 percent [i.e., AR/(1+R) = -0.005], what will be the expected impact on the market value of equity? g. What is the change in the value of the firm's assets for relative upward shift in the entire yield curve of 0.1 percent? h. What is the change in the value of the firm's liabilities for relative downward shift in the entire yield curve of 0.8 percent? i. What is the resulting change in the value of equity for the firm by keeping in view point g and h

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts