Question: please solve it in 10 mins I will thumb you up. please fast 6.6666 points Save Answer XYZ operates indoor tracks. The firm is evaluating

please solve it in 10 mins I will thumb you up. please fast

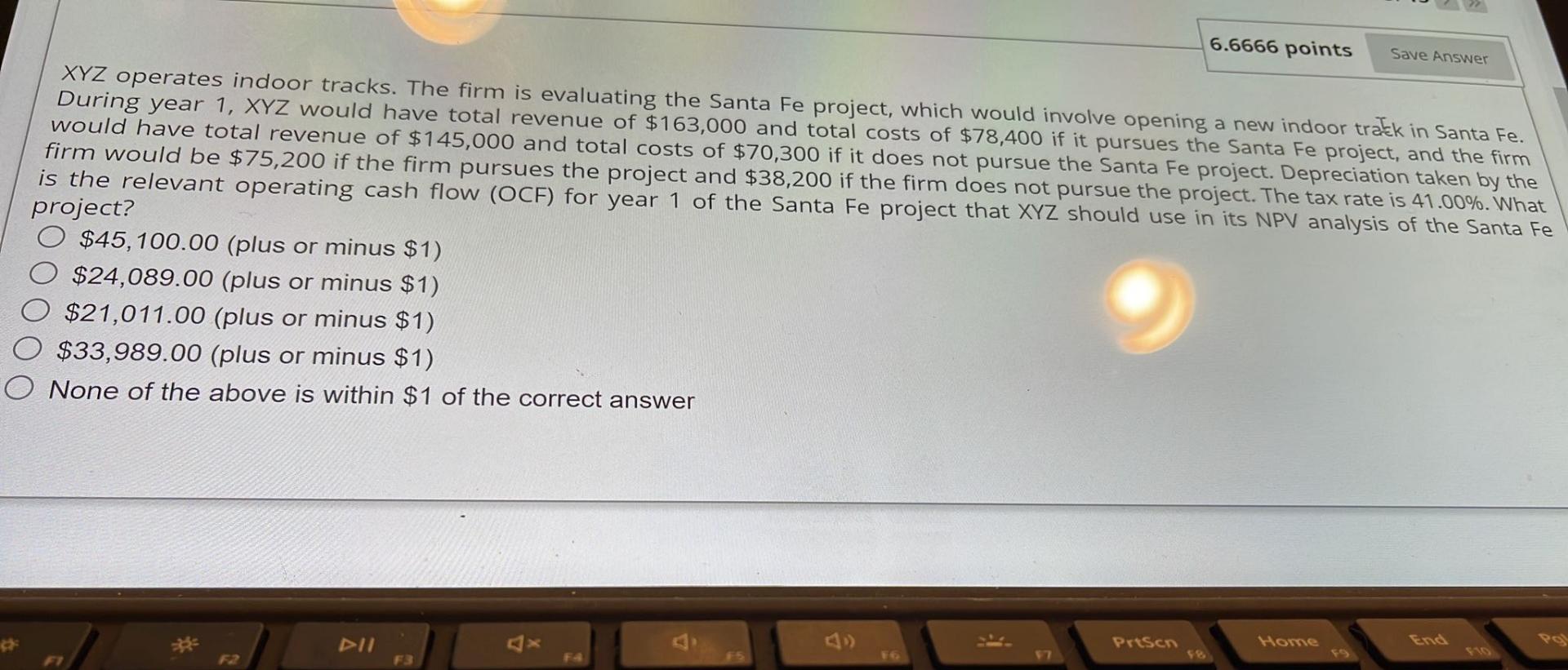

6.6666 points Save Answer XYZ operates indoor tracks. The firm is evaluating the Santa Fe project, which would involve opening a new indoor track in Santa Fe. During year 1, XYZ would have total revenue of $163,000 and total costs of $78,400 if it pursues the Santa Fe project, and the firm would have total revenue of $145,000 and total costs of $70,300 if it does not pursue the Santa Fe project. Depreciation taken by the firm would be $75,200 if the firm pursues the project and $38,200 if the firm does not pursue the project. The tax rate is 41.00%. What is the relevant operating cash flow (OCF) for year 1 of the Santa Fe project that XYZ should use in its NPV analysis of the Santa Fe project? $45,100.00 (plus or minus $1) $24,089.00 (plus or minus $1) $21,011.00 (plus or minus $1) $33,989.00 (plus or minus $1) None of the above is within $1 of the correct answer PrtScn Home DII # F4 F3 97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts