Question: please solve it in 10 mins I will thumb you up please I have 10 mins only Moving to another question will save this response.

please solve it in 10 mins I will thumb you up please I have 10 mins only

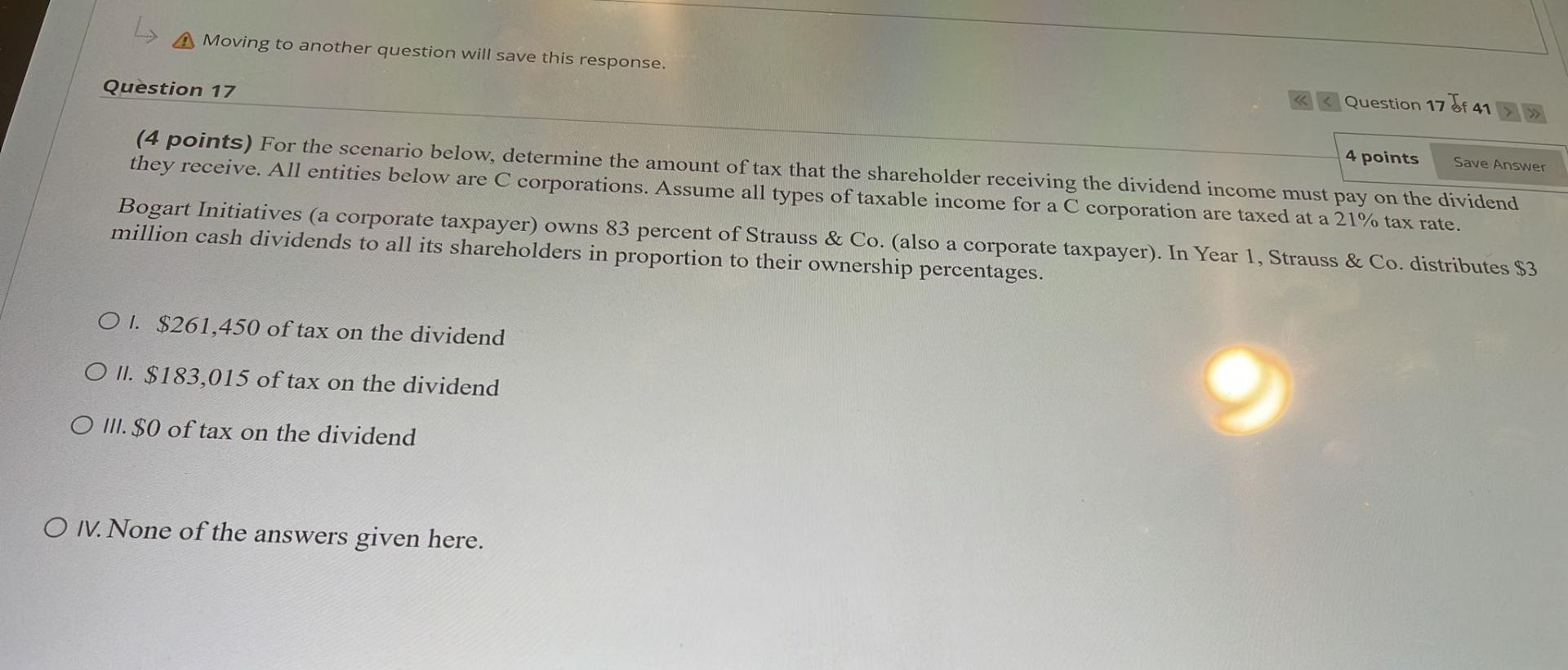

Moving to another question will save this response. Question 17 4 points (4 points) For the scenario below, determine the amount of tax that the shareholder receiving the dividend income must pay on the dividend they receive. All entities below are C corporations. Assume all types of taxable income for a C corporation are taxed at a 21% tax rate. Question 17 f 41 OI. $261,450 of tax on the dividend O II. $183,015 of tax on the dividend O III. $0 of tax on the dividend Bogart Initiatives (a corporate taxpayer) owns 83 percent of Strauss & Co. (also a corporate taxpayer). In Year 1, Strauss & Co. distributes $3 million cash dividends to all its shareholders in proportion to their ownership percentages. O IV. None of the answers given here. Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts