Question: please solve it in 10 mins I will thumb you up please I have 10 mins only L A Moving to another question will save

please solve it in 10 mins I will thumb you up please I have 10 mins only

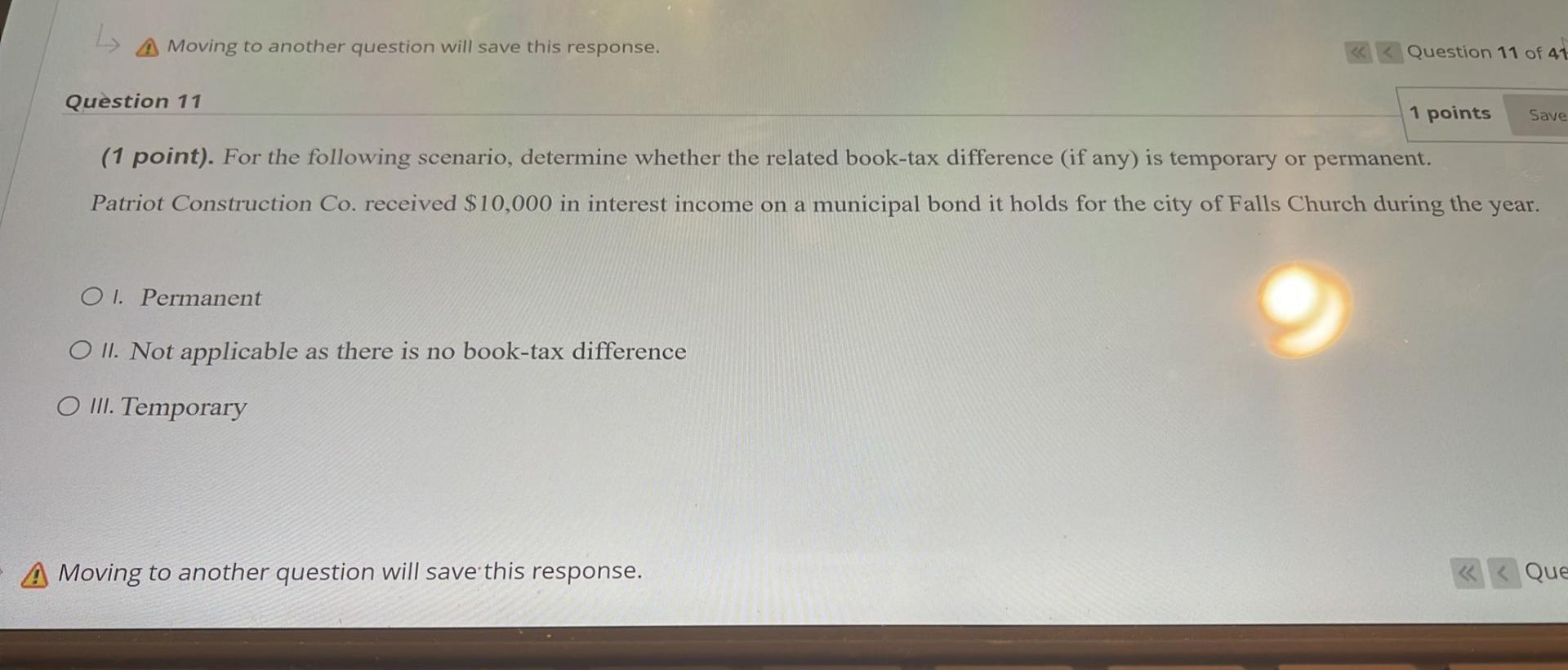

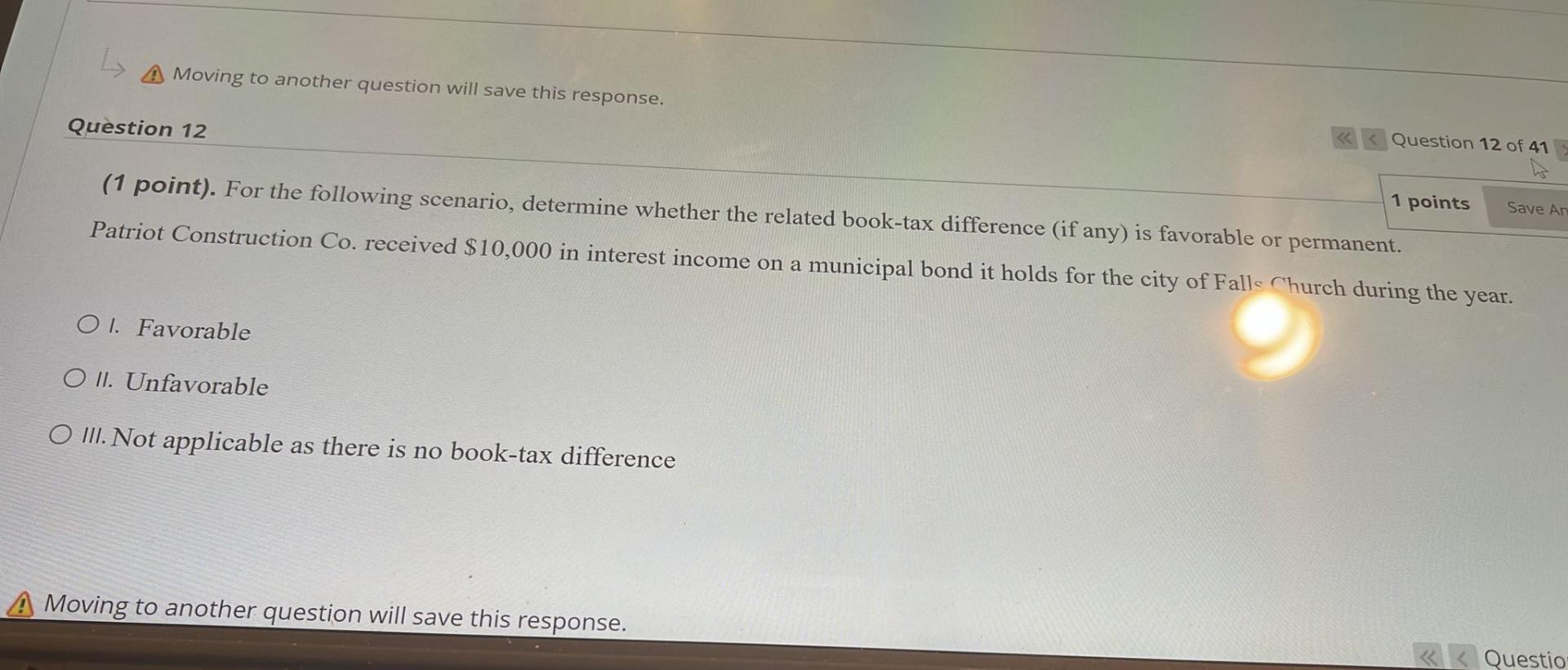

L A Moving to another question will save this response. Question 11 OI. Permanent (1 point). For the following scenario, determine whether the related book-tax difference (if any) is temporary or permanent. Patriot Construction Co. received $10,000 in interest income on a municipal bond it holds for the city of Falls Church during the year. O II. Not applicable as there is no book-tax difference O III. Temporary Question 11 of 41 A Moving to another question will save this response. 1 points Save Que L A Moving to another question will save this response. Question 12 (1 point). For the following scenario, determine whether the related book-tax difference (if any) is favorable or permanent. Patriot Construction Co. received $10,000 in interest income on a municipal bond it holds for the city of Falls Church during the year. OI. Favorable O II. Unfavorable O III. Not applicable as there is no book-tax difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts