Question: please solve it in 10 mins I will thumb you up please I have 10 mins only Moving to another question will save this response.

please solve it in 10 mins I will thumb you up please I have 10 mins only

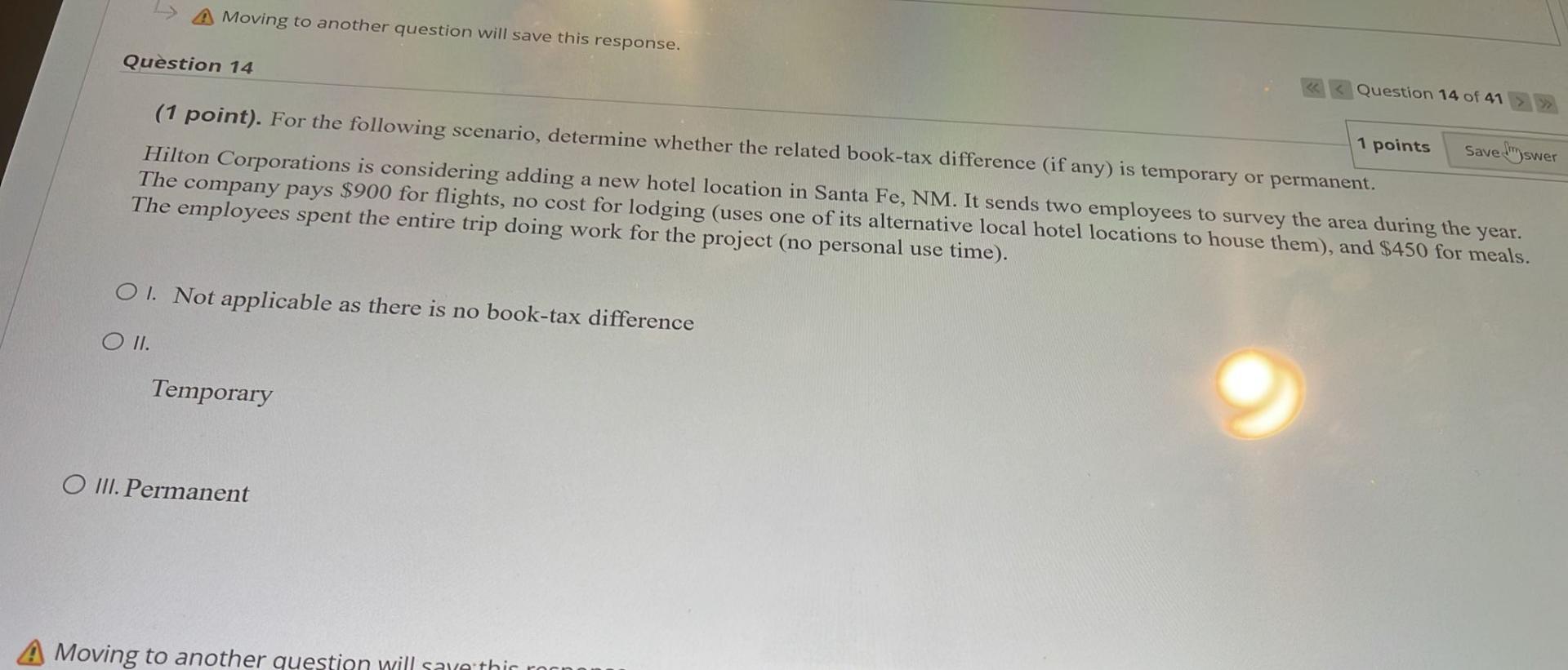

Moving to another question will save this response. Question 14 (1 point). For the following scenario, determine whether the related book-tax difference (if any) is temporary or permanent. Hilton Corporations is considering adding a new hotel location in Santa Fe, NM. It sends two employees to survey the area during the year. The company pays $900 for flights, no cost for lodging (uses one of its alternative local hotel locations to house them), and $450 for meals. The employees spent the entire trip doing work for the project (no personal use time). OI. Not applicable as there is no book-tax difference O II. Temporary O III. Permanent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts