Question: please solve it in 10 mins I will thumb you up please I have 10 mins only Question 29 loh will save this response. 4

please solve it in 10 mins I will thumb you up please I have 10 mins only

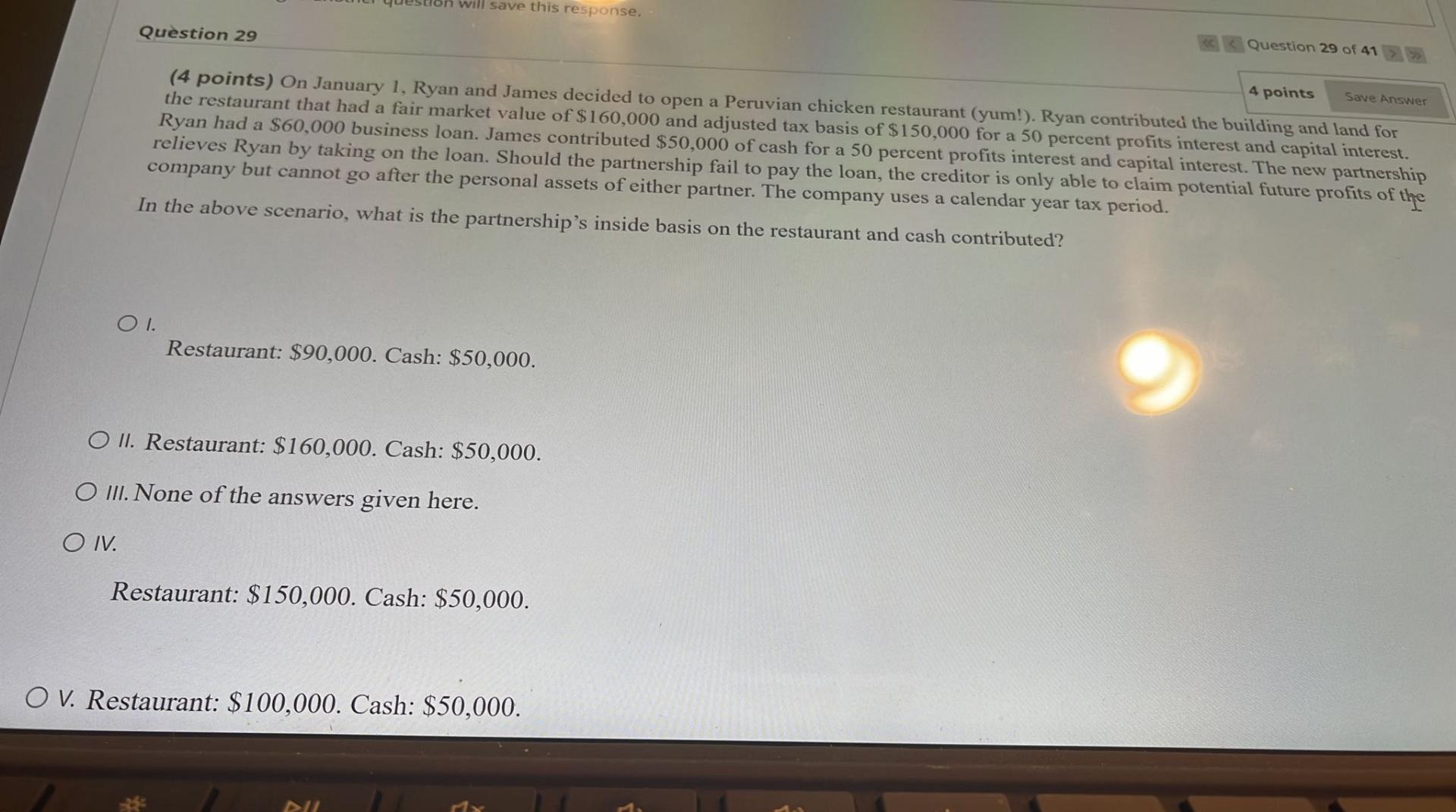

Question 29 loh will save this response. 4 points Save Answer (4 points) On January 1, Ryan and James decided to open a Peruvian chicken restaurant (yum!). Ryan contributed the building and land for the restaurant that had a fair market value of $160,000 and adjusted tax basis of $150,000 for a 50 percent profits interest and capital interest. Ryan had a $60,000 business loan. James contributed $50,000 of cash for a 50 percent profits interest and capital interest. The new partnership relieves Ryan by taking on the loan. Should the partnership fail to pay the loan, the creditor is only able to claim potential future profits of the company but cannot go after the personal assets of either partner. The company uses a calendar year tax period. In the above scenario, what is the partnership's inside basis on the restaurant and cash contributed? OI. Restaurant: $90,000. Cash: $50,000. O II. Restaurant: $160,000. Cash: $50,000. O III. None of the answers given here. O IV. Restaurant: $150,000. Cash: $50,000. OV. Restaurant: $100,000. Cash: $50,000. Question 29 of 41

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts