Question: please solve it in 10 mins I will thumb you up Remaining Time: 2 hours, 15 minutes, 13 seconds. Question Completion Status: 10 20 26

please solve it in 10 mins I will thumb you up

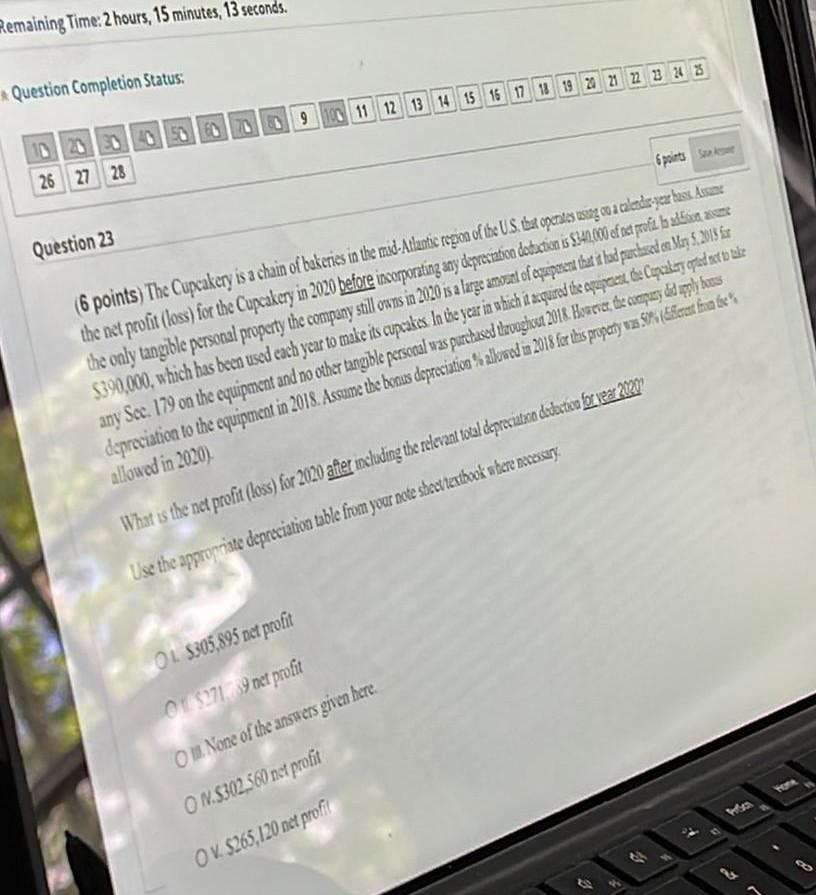

Remaining Time: 2 hours, 15 minutes, 13 seconds. Question Completion Status: 10 20 26 27 28 050 60 70 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Question 23 6 points S (6 points) The Cupcakery is a chain of bakeries in the mid-Atlantic region of the U.S. that operates using on a calendar-year bass. Assume the net profit (loss) for the Cupcakery in 2020 before incorporating any depreciation deduction is $340,000 of net profit. In addition, asume the only tangible personal property the company still owns in 2020 is a large amount of equipment that it had purchased on May 5, 2018 for $390,000, which has been used each year to make its cupcakes. In the year in which it acquired the equipment, the Cupcakery opted not to take any Sec. 179 on the equipment and no other tangible personal was purchased throughout 2018. However, the company did apply bonus depreciation to the equipment in 2018. Assume the bonus depreciation % allowed in 2018 for this property was 50% (diferent from the% allowed in 2020) What is the net profit (loss) for 2020 after including the relevant total depreciation deduction for year 2020 Use the appropriate depreciation table from your note sheet/textbook where necessary. OL $305,895 net profit O $271,089 net profit O None of the answers given here. ON.S302,560 net profit OV. $265,120 net profil & B Remaining Time: 2 hours, 15 minutes, 13 seconds. Question Completion Status: 10 20 26 27 28 050 60 70 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Question 23 6 points S (6 points) The Cupcakery is a chain of bakeries in the mid-Atlantic region of the U.S. that operates using on a calendar-year bass. Assume the net profit (loss) for the Cupcakery in 2020 before incorporating any depreciation deduction is $340,000 of net profit. In addition, asume the only tangible personal property the company still owns in 2020 is a large amount of equipment that it had purchased on May 5, 2018 for $390,000, which has been used each year to make its cupcakes. In the year in which it acquired the equipment, the Cupcakery opted not to take any Sec. 179 on the equipment and no other tangible personal was purchased throughout 2018. However, the company did apply bonus depreciation to the equipment in 2018. Assume the bonus depreciation % allowed in 2018 for this property was 50% (diferent from the% allowed in 2020) What is the net profit (loss) for 2020 after including the relevant total depreciation deduction for year 2020 Use the appropriate depreciation table from your note sheet/textbook where necessary. OL $305,895 net profit O $271,089 net profit O None of the answers given here. ON.S302,560 net profit OV. $265,120 net profil & B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts