Question: please solve it in 10 mins I will thumb you up 9). Assume that the Mexican peso exhibits a 6-month interest rate of 6.5 percent,

please solve it in 10 mins I will thumb you up

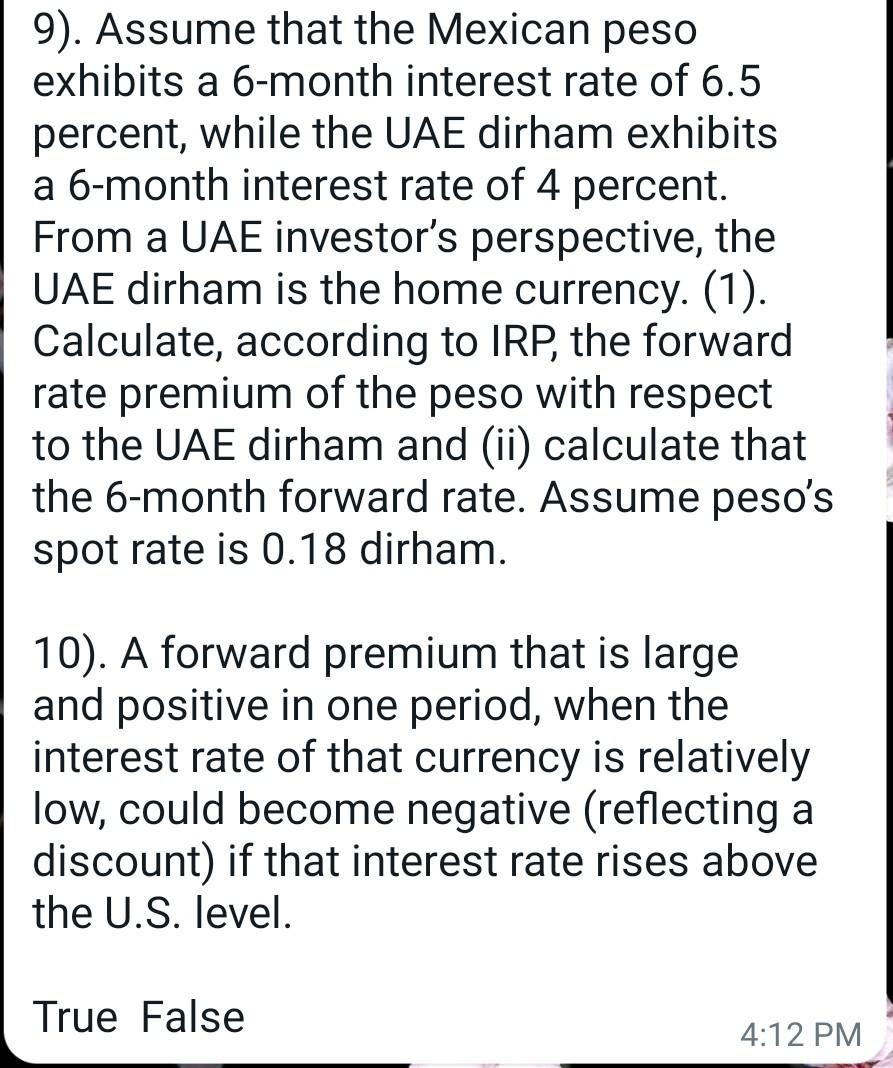

9). Assume that the Mexican peso exhibits a 6-month interest rate of 6.5 percent, while the UAE dirham exhibits a 6-month interest rate of 4 percent. From a UAE investor's perspective, the UAE dirham is the home currency. (1). Calculate, according to IRP, the forward rate premium of the peso with respect to the UAE dirham and (ii) calculate that the 6-month forward rate. Assume peso's spot rate is 0.18 dirham. 10). A forward premium that is large and positive in one period, when the interest rate of that currency is relatively low, could become negative (reflecting a discount) if that interest rate rises above the U.S. level. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts