Question: please solve it in 20 mins I will thumb you up QUESTION 10 T.Swift & co. sells breakup songs. The company has 7 million shares

please solve it in 20 mins I will thumb you up

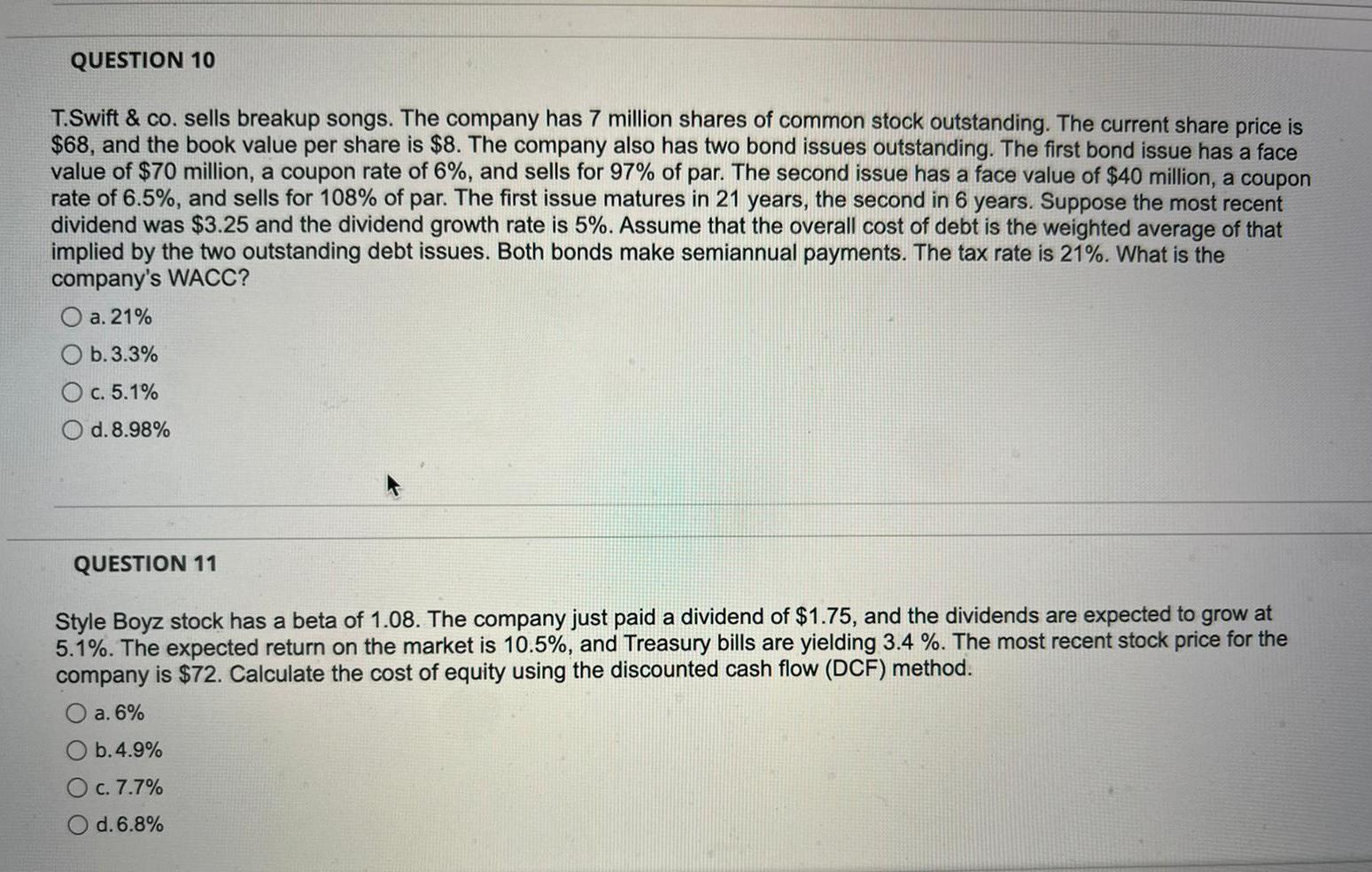

QUESTION 10 T.Swift & co. sells breakup songs. The company has 7 million shares of common stock outstanding. The current share price is $68, and the book value per share is $8. The company also has two bond issues outstanding. The first bond issue has a face value of $70 million, a coupon rate of 6%, and sells for 97% of par. The second issue has a face value of $40 million, a coupon rate of 6.5%, and sells for 108% of par. The first issue matures in 21 years, the second in 6 years. Suppose the most recent dividend was $3.25 and the dividend growth rate is 5%. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 21%. What is the company's WACC? O a. 21% b.3.3% O c. 5.1% O d. 8.98% QUESTION 11 Style Boyz stock has a beta of 1.08. The company just paid a dividend of $1.75, and the dividends are expected to grow at 5.1%. The expected return on the market is 10.5%, and Treasury bills are yielding 3.4 %. The most recent stock price for the company is $72. Calculate the cost of equity using the discounted cash flow (DCF) method. a. 6% b.4.9% C. 7.7% d. 6.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts