Question: please solve it in 30 minute Question 4 Diacono Ltd, is the largest listed shoe manufacturing company in Australia and is considering launching a bid

please solve it in 30 minute

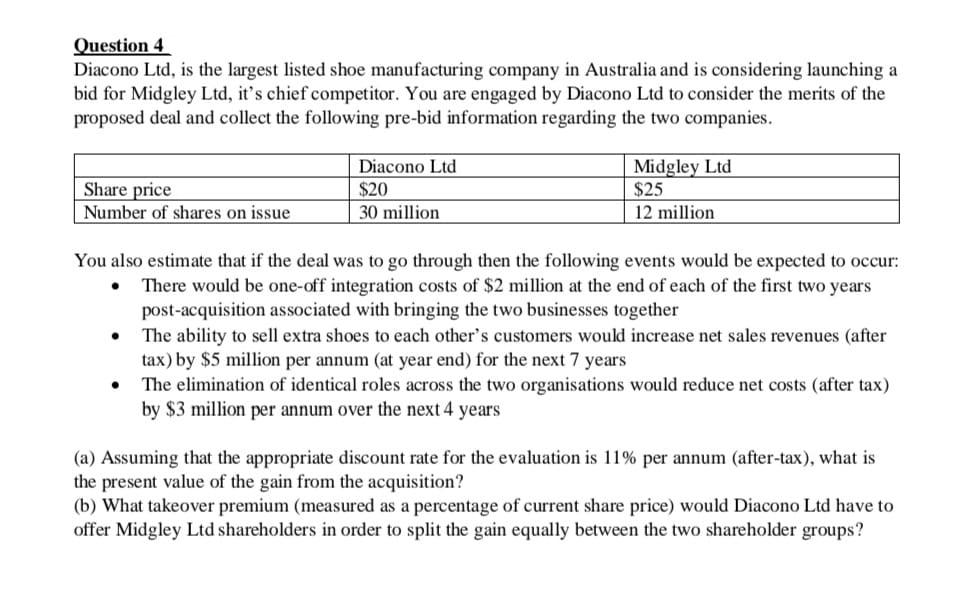

Question 4 Diacono Ltd, is the largest listed shoe manufacturing company in Australia and is considering launching a bid for Midgley Ltd, it's chief competitor. You are engaged by Diacono Ltd to consider the merits of the proposed deal and collect the following pre-bid information regarding the two companies. Share price Number of shares on issue Diacono Ltd $20 30 million Midgley Ltd $25 12 million You also estimate that if the deal was to go through then the following events would be expected to occur: There would be one-off integration costs of $2 million at the end of each of the first two years post-acquisition associated with bringing the two businesses together The ability to sell extra shoes to each other's customers would increase net sales revenues (after tax) by $5 million per annum (at year end) for the next 7 years The elimination of identical roles across the two organisations would reduce net costs (after tax) by $3 million per annum over the next 4 years . . (a) Assuming that the appropriate discount rate for the evaluation is 11% per annum (after-tax), what is the present value of the gain from the acquisition? (b) What takeover premium (measured as a percentage of current share price) would Diacono Ltd have to offer Midgley Ltd shareholders in order to split the gain equally between the two shareholder groups

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts