Question: please solve it in 30 minute Question 6 ABC Inc is a publicly listed company in Australia and pays corporate tax rate at a rate

please solve it in 30 minute

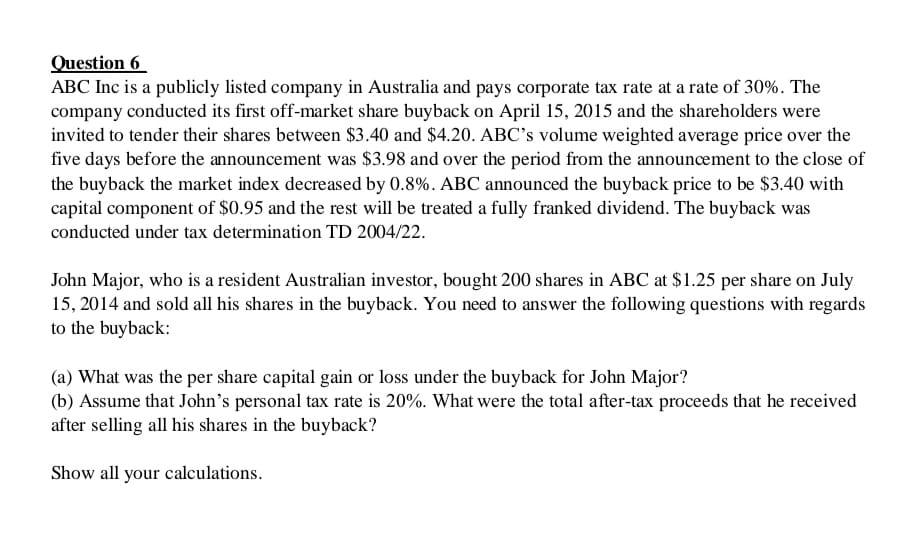

Question 6 ABC Inc is a publicly listed company in Australia and pays corporate tax rate at a rate of 30%. The company conducted its first off-market share buyback on April 15, 2015 and the shareholders were invited to tender their shares between $3.40 and $4.20. ABC's volume weighted average price over the five days before the announcement was $3.98 and over the period from the announcement to the close of the buyback the market index decreased by 0.8%. ABC announced the buyback price to be $3.40 with capital component of $0.95 and the rest will be treated a fully franked dividend. The buyback was conducted under tax determination TD 2004/22. John Major, who is a resident Australian investor, bought 200 shares in ABC at $1.25 per share on July 15, 2014 and sold all his shares in the buyback. You need to answer the following questions with regards to the buyback: (a) What was the per share capital gain or loss under the buyback for John Major? (b) Assume that John's personal tax rate is 20%. What were the total after-tax proceeds that he received after selling all his shares in the buyback? Show all your calculations. Question 6 ABC Inc is a publicly listed company in Australia and pays corporate tax rate at a rate of 30%. The company conducted its first off-market share buyback on April 15, 2015 and the shareholders were invited to tender their shares between $3.40 and $4.20. ABC's volume weighted average price over the five days before the announcement was $3.98 and over the period from the announcement to the close of the buyback the market index decreased by 0.8%. ABC announced the buyback price to be $3.40 with capital component of $0.95 and the rest will be treated a fully franked dividend. The buyback was conducted under tax determination TD 2004/22. John Major, who is a resident Australian investor, bought 200 shares in ABC at $1.25 per share on July 15, 2014 and sold all his shares in the buyback. You need to answer the following questions with regards to the buyback: (a) What was the per share capital gain or loss under the buyback for John Major? (b) Assume that John's personal tax rate is 20%. What were the total after-tax proceeds that he received after selling all his shares in the buyback? Show all your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts