Question: Please solve it in docx format, step wise. Thank you! Invesco's S&P 500 ETF (SPIAX) currently trades at a price of $44.55 and just paid

Please solve it in docx format, step wise. Thank you!

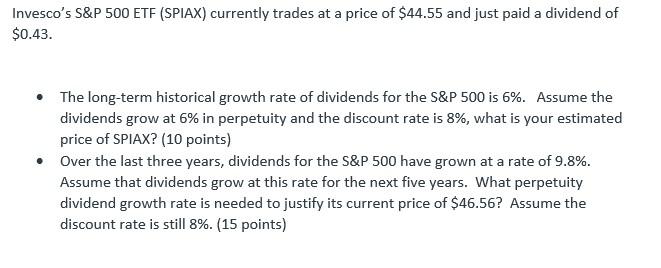

Invesco's S&P 500 ETF (SPIAX) currently trades at a price of $44.55 and just paid a dividend of $0.43. The long-term historical growth rate of dividends for the S&P 500 is 6%. Assume the dividends grow at 6% in perpetuity and the discount rate is 8%, what is your estimated price of SPIAX? (10 points) Over the last three years, dividends for the S&P 500 have grown at a rate of 9.8%. Assume that dividends grow at this rate for the next five years. What perpetuity dividend growth rate is needed to justify its current price of $46.56? Assume the discount rate is still 8%. (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts