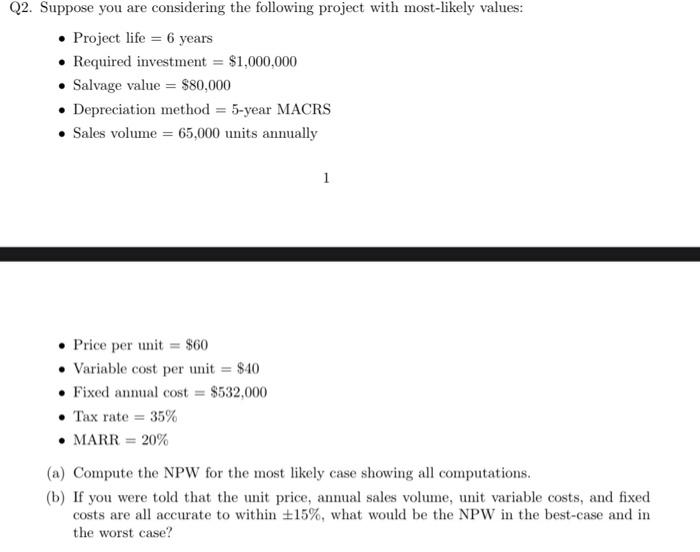

Question: please solve it manually Q2. Suppose you are considering the following project with most-likely values: Project life = 6 years Required investment = $1,000,000 Salvage

Q2. Suppose you are considering the following project with most-likely values: Project life = 6 years Required investment = $1,000,000 Salvage value = $80,000 Depreciation method = 5-year MACRS Sales volume = 65,000 units annually 1 Price per unit = $60 Variable cost per unit = $40 Fixed annual cost = $532,000 Tax rate = 35% MARR = 20% (a) Compute the NPW for the most likely case showing all computations. (b) If you were told that the unit price, annual sales volume, unit variable costs, and fixed costs are all accurate to within +15%, what would be the NPW in the best-case and in the worst case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts