Question: Please solve it manually using formula don't use excel shortcuts.Thank you Replacement project Problem 6-17: National Paper Company is contemplating the replacement of one of

Please solve it manually using formula don't use excel shortcuts.Thank you

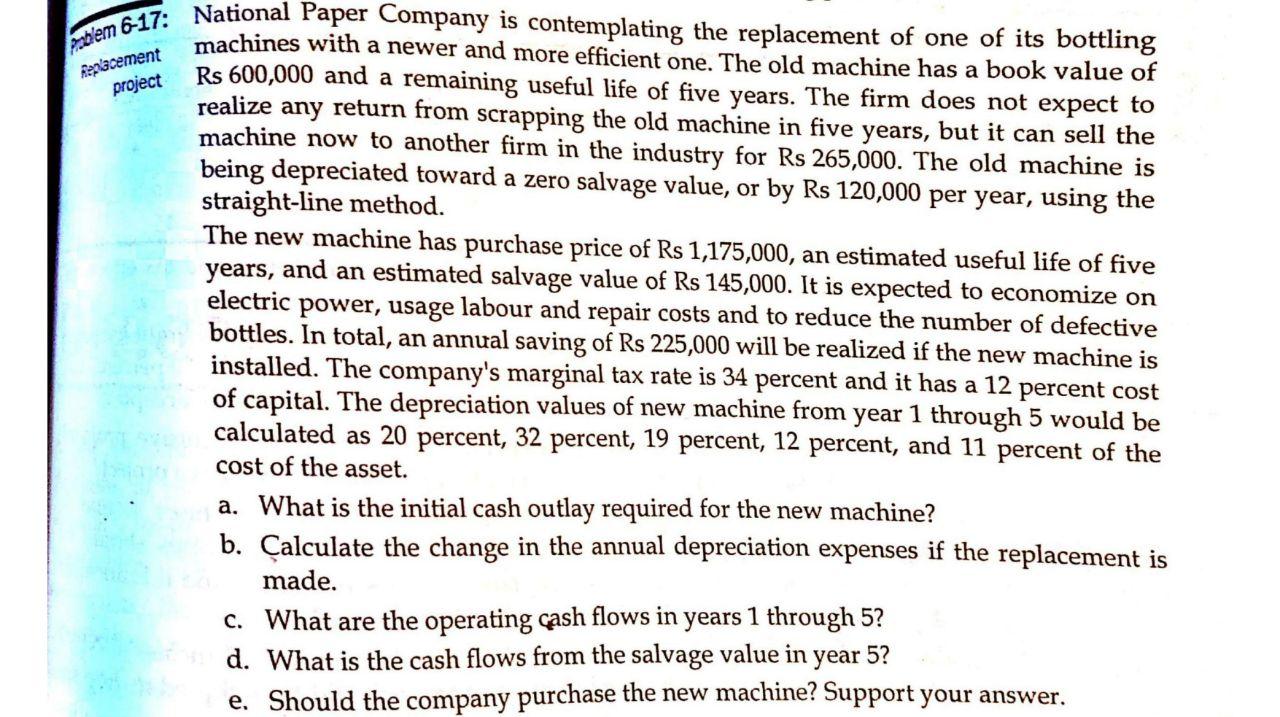

Replacement project Problem 6-17: National Paper Company is contemplating the replacement of one of its bottling machines with a newer and more efficient one. The old machine has a book value of Rs 600,000 and a remaining useful life of five years. The firm does not expect to realize any return from scrapping the old machine in five years, but it can sell the machine now to another firm in the industry for Rs 265,000. The old machine is being depreciated toward a zero salvage value, or by Rs 120,000 per year, using the straight-line method. The new machine has purchase price of Rs 1,175,000, an estimated useful life of five years, and an estimated salvage value of Rs 145,000. It is expected to economize on electric power, usage labour and repair costs and to reduce the number of defective bottles. In total, an annual saving of Rs 225,000 will be realized if the new machine is installed. The company's marginal tax rate is 34 percent and it has a 12 percent cost of capital. The depreciation values of new machine from year 1 through 5 would be calculated as 20 percent, 32 percent, 19 percent, 12 percent, and 11 percent of the cost of the asset. a. What is the initial cash outlay required for the new machine? b. Calculate the change in the annual depreciation expenses if the replacement is made. C. What are the operating cash flows in years 1 through 5? d. What is the cash flows from the salvage value in year 5? e. Should the company purchase the new machine? Support your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts