Question: please solve it manually,do not use excel 2 Matilda is a financial advisor who manages wealth for high-net-worth individuals. For a particular client, she recommends

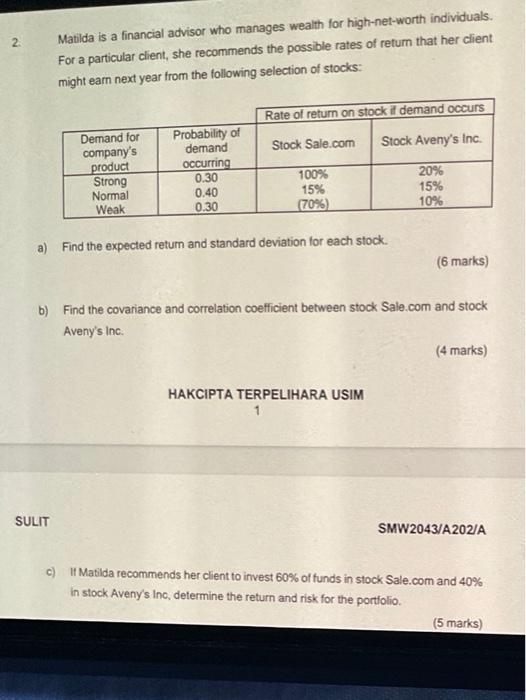

2 Matilda is a financial advisor who manages wealth for high-net-worth individuals. For a particular client, she recommends the possible rates of retum that her client might earn next year from the following selection of stocks: Rate of return on stock if demand occurs Stock Sale.com Stock Aveny's Inc Demand for company's product Strong Normal Weak Probability of demand occurring 0.30 0.40 0.30 100% 15% (70%) 20% 15% 10% a) Find the expected return and standard deviation for each stock. (6 marks) b) Find the covariance and correlation coefficient between stock Sale.com and stock Aveny's Inc (4 marks) HAKCIPTA TERPELIHARA USIM SULIT SMW2043/A202/A c) It Matilda recommends her client to invest 60% of funds in stock Sale.com and 40% in stock Aveny's Inc, determine the return and risk for the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts