Question: Please solve it on excel in proper ways ASAP The Salida Salt Company is considering making a bid to supply the highway department with rock

Please solve it on excel in proper ways ASAP

Please solve it on excel in proper ways ASAP

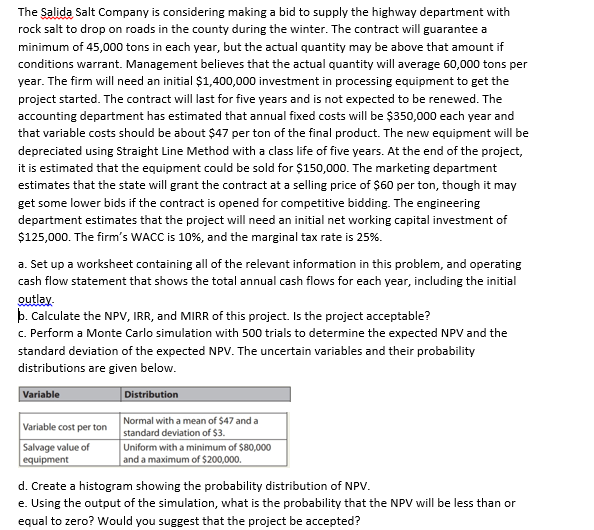

The Salida Salt Company is considering making a bid to supply the highway department with rock salt to drop on roads in the county during the winter. The contract will guarantee a minimum of 45,000 tons in each year, but the actual quantity may be above that amount if conditions warrant. Management believes that the actual quantity will average 60,000 tons per year. The firm will need an initial $1,400,000 investment in processing equipment to get the project started. The contract will last for five years and is not expected to be renewed. The accounting department has estimated that annual fixed costs will be $350,000 each year and that variable costs should be about $47 per ton of the final product. The new equipment will be depreciated using Straight Line Method with a class life of five years. At the end of the project, it is estimated that the equipment could be sold for $150,000. The marketing department estimates that the state will grant the contract at a selling price of $60 per ton, though it may get some lower bids if the contract is opened for competitive bidding. The engineering department estimates that the project will need an initial net working capital investment of $125,000. The firm's WACC is 10%, and the marginal tax rate is 25%. a. Set up a worksheet containing all of the relevant information in this problem, and operating cash flow statement that shows the total annual cash flows for each year, including the initial outlay b. Calculate the NPV, IRR, and MIRR of this project. Is the project acceptable? c. Perform a Monte Carlo simulation with 500 trials to determine the expected NPV and the standard deviation of the expected NPV. The uncertain variables and their probability distributions are given below. Distribution Variable Variable cost per ton Normal with a mean of $47 and a standard deviation of $3. Salvage value of Uniform with a minimum of $80,000 equipment and a maximum of $200,000 d. Create a histogram showing the probability distribution of NPV. e. Using the output of the simulation, what is the probability that the NPV will be less than or equal to zero? Would you suggest that the project be accepted? The Salida Salt Company is considering making a bid to supply the highway department with rock salt to drop on roads in the county during the winter. The contract will guarantee a minimum of 45,000 tons in each year, but the actual quantity may be above that amount if conditions warrant. Management believes that the actual quantity will average 60,000 tons per year. The firm will need an initial $1,400,000 investment in processing equipment to get the project started. The contract will last for five years and is not expected to be renewed. The accounting department has estimated that annual fixed costs will be $350,000 each year and that variable costs should be about $47 per ton of the final product. The new equipment will be depreciated using Straight Line Method with a class life of five years. At the end of the project, it is estimated that the equipment could be sold for $150,000. The marketing department estimates that the state will grant the contract at a selling price of $60 per ton, though it may get some lower bids if the contract is opened for competitive bidding. The engineering department estimates that the project will need an initial net working capital investment of $125,000. The firm's WACC is 10%, and the marginal tax rate is 25%. a. Set up a worksheet containing all of the relevant information in this problem, and operating cash flow statement that shows the total annual cash flows for each year, including the initial outlay b. Calculate the NPV, IRR, and MIRR of this project. Is the project acceptable? c. Perform a Monte Carlo simulation with 500 trials to determine the expected NPV and the standard deviation of the expected NPV. The uncertain variables and their probability distributions are given below. Distribution Variable Variable cost per ton Normal with a mean of $47 and a standard deviation of $3. Salvage value of Uniform with a minimum of $80,000 equipment and a maximum of $200,000 d. Create a histogram showing the probability distribution of NPV. e. Using the output of the simulation, what is the probability that the NPV will be less than or equal to zero? Would you suggest that the project be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts