Question: Please solve it. On July 1 , the directors declare a 5% stock dividend distributable on July 31 to the July 18 stockholders of record.

Please solve it.

Please solve it.

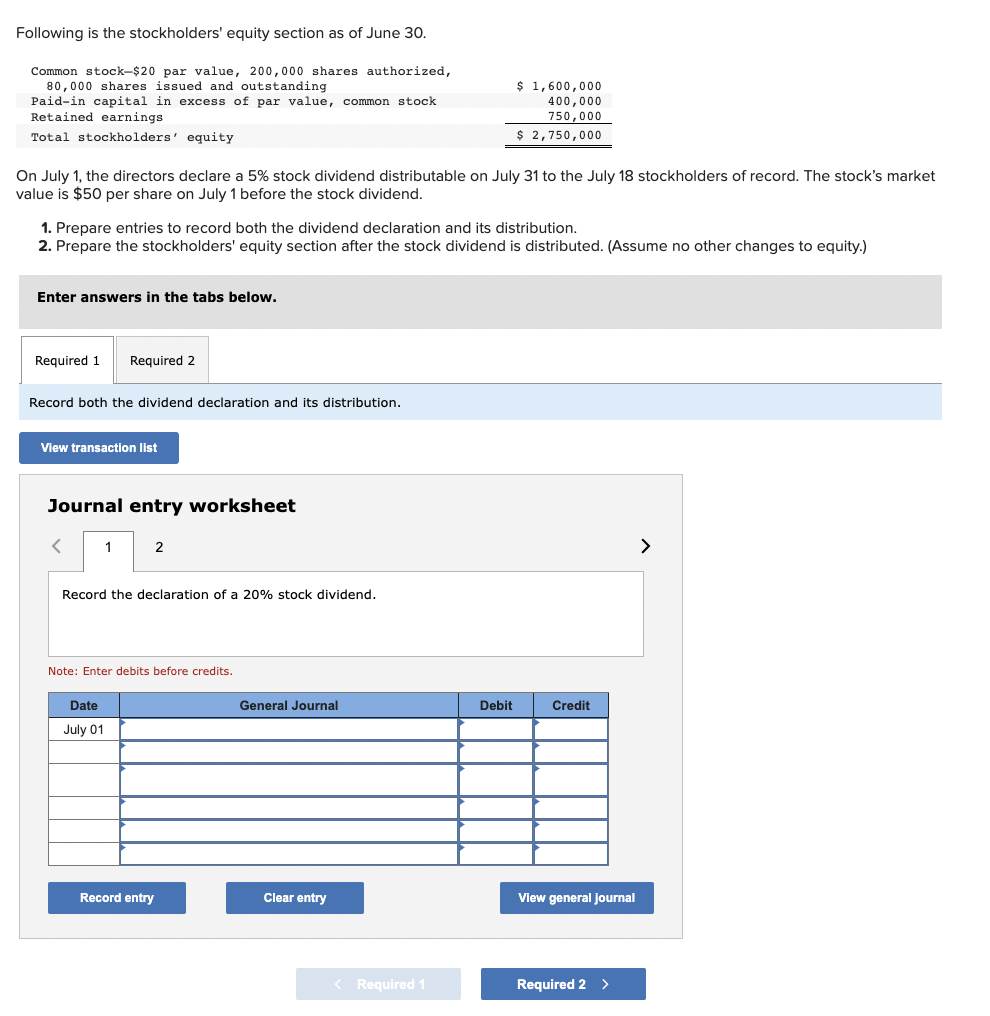

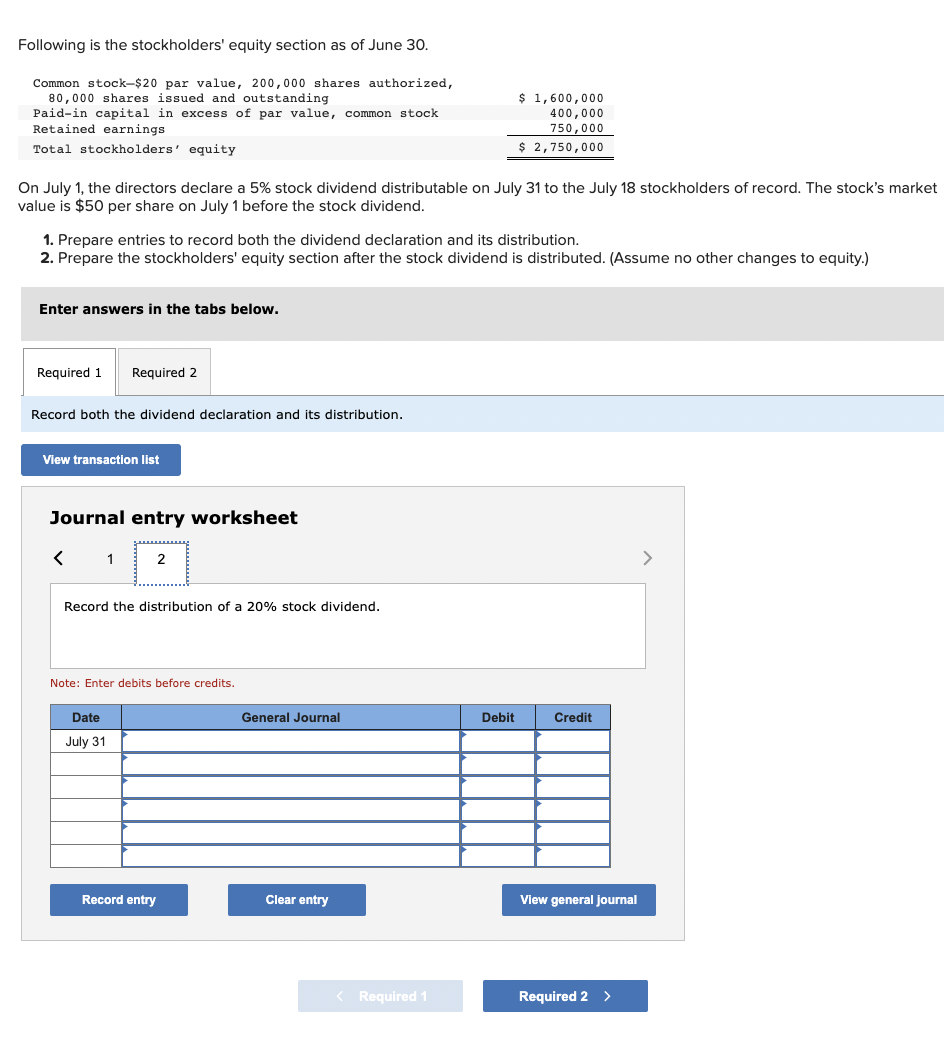

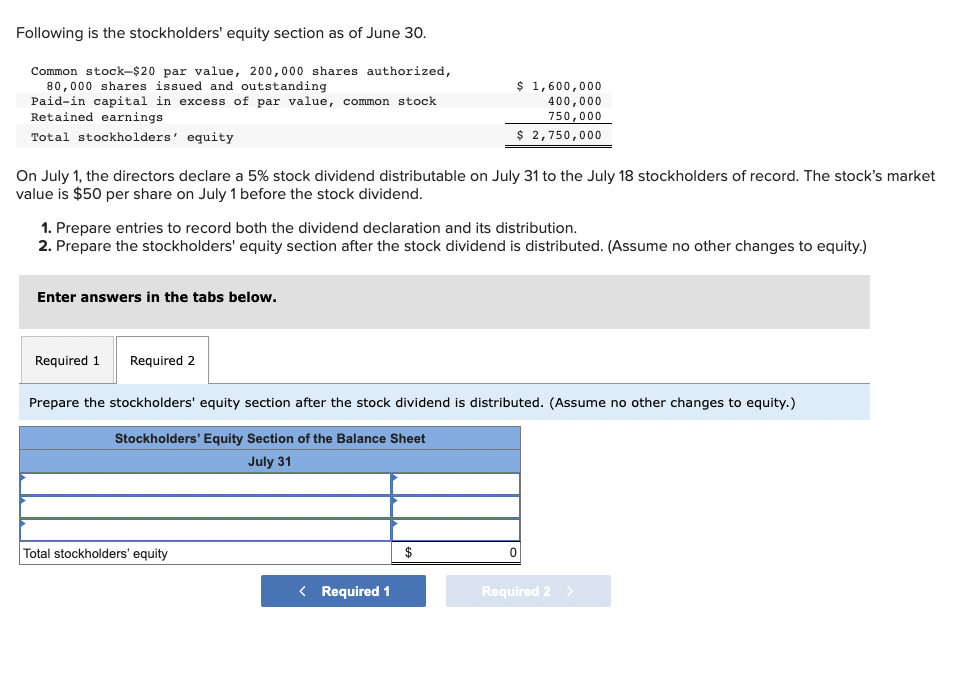

On July 1 , the directors declare a 5% stock dividend distributable on July 31 to the July 18 stockholders of record. The stock's market value is $50 per share on July 1 before the stock dividend. 1. Prepare entries to record both the dividend declaration and its distribution. 2. Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) Enter answers in the tabs below. Record both the dividend declaration and its distribution. Journal entry worksheet Record the declaration of a 20% stock dividend. Note: Enter debits before credits. On July 1 , the directors declare a 5% stock dividend distributable on July 31 to the July 18 stockholders of record. The stock's market value is $50 per share on July 1 before the stock dividend. 1. Prepare entries to record both the dividend declaration and its distribution. 2. Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) Enter answers in the tabs below. Record both the dividend declaration and its distribution. Journal entry worksheet Record the distribution of a 20% stock dividend. Note: Enter debits before credits. On July 1, the directors declare a 5% stock dividend distributable on July 31 to the July 18 stockholders of record. The stock's mark value is $50 per share on July 1 before the stock dividend. 1. Prepare entries to record both the dividend declaration and its distribution. 2. Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) Enter answers in the tabs below. Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts