Question: please solve it please solve it as soon as possible. thanks. Notice that for this problem were asked to estimate the WACC We are vente

please solve it

please solve it as soon as possible. thanks.

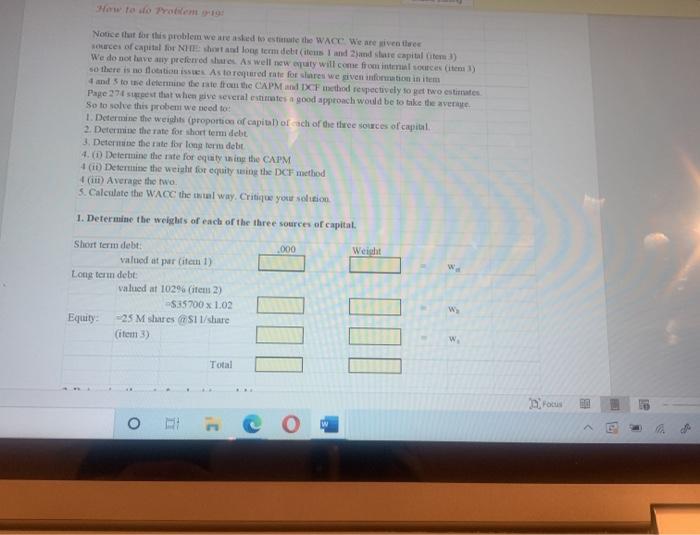

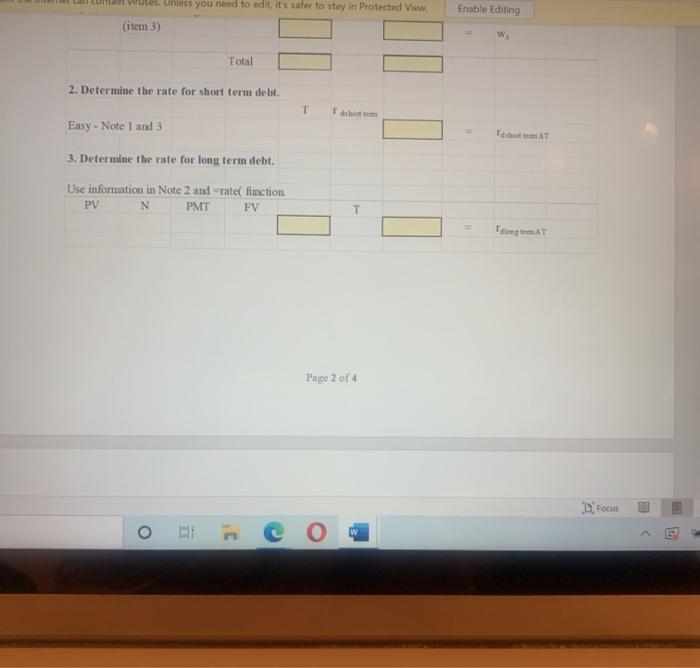

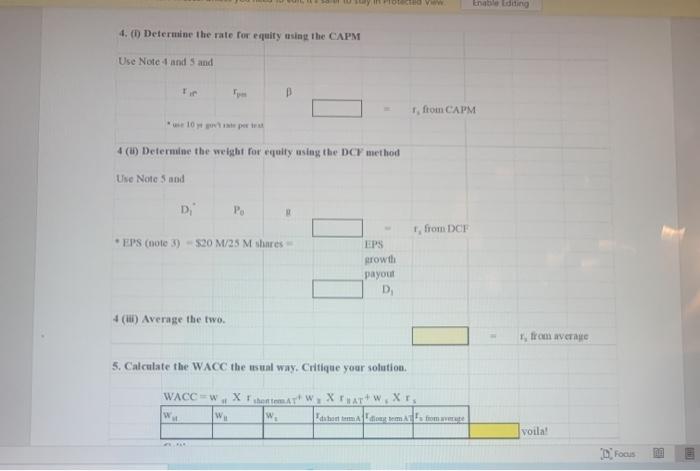

Notice that for this problem were asked to estimate the WACC We are vente sources of capital for NHL show long term debt (items and and share capital (item )) We do not have my preferred share. As well new aty will come from internal conces ciems) so there is no otition is Astorgard rate for shares we siven information in item 4 and 3 to the determine the rate to the CAPMF chod respectively to get two estimates Page 27 gest that when ulve several estimates a good approach would be to take the average So to solve this proben we tied to 1. Determine the weights (proportion of capital of ach of the three sources of capital 2. Determine the rate for short tem debt 3. Determine the rate for long term debit 4.) Determine the rate for equity thing the CAPM 4 (1) Determine the weight for equity wsing the DCF method (1) Average the two 3. Calculate the WACC the total way. Critique your sitio 1. Determine the weights of each of the three sources of capital. 000 Weight w Short term debt valued at pur Citan 1) Long term debt valued at 10296 (item 2) $35 700 x 1.02 Equity -25 M shares Sit/share (item 3) w Total Focus o TE com vises. Unless you need to edit it's safer to stay in Protected View Enable Editing (item 3) w Total 2. Determine the rate for short term debt. T Easy - Note 1 and 3 Techon mAT 3. Determine the rate for long term debt. Use information in Note 2 and rate fiuction PV N PMT FV TAT Page 2 of 4 Droem O w 10V Enable Editing 4. (D Determine the rate for equity using the CAPM Use Note-tand and from CAPM 4 (1) Determine the weight for equity using the DC method Use Notc Sand D, Po 1, from DCF EPS (note 3) $20 M/25M shares EPS growth payout D 4 (1) Average the two Iron average 5. Calculate the WACC the tisual way. Critique your solution. WACC w X FontArt W, X THAT W.Xr. W. w dabartma tothom from west w voila! D Focus Notice that for this problem were asked to estimate the WACC We are vente sources of capital for NHL show long term debt (items and and share capital (item )) We do not have my preferred share. As well new aty will come from internal conces ciems) so there is no otition is Astorgard rate for shares we siven information in item 4 and 3 to the determine the rate to the CAPMF chod respectively to get two estimates Page 27 gest that when ulve several estimates a good approach would be to take the average So to solve this proben we tied to 1. Determine the weights (proportion of capital of ach of the three sources of capital 2. Determine the rate for short tem debt 3. Determine the rate for long term debit 4.) Determine the rate for equity thing the CAPM 4 (1) Determine the weight for equity wsing the DCF method (1) Average the two 3. Calculate the WACC the total way. Critique your sitio 1. Determine the weights of each of the three sources of capital. 000 Weight w Short term debt valued at pur Citan 1) Long term debt valued at 10296 (item 2) $35 700 x 1.02 Equity -25 M shares Sit/share (item 3) w Total Focus o TE com vises. Unless you need to edit it's safer to stay in Protected View Enable Editing (item 3) w Total 2. Determine the rate for short term debt. T Easy - Note 1 and 3 Techon mAT 3. Determine the rate for long term debt. Use information in Note 2 and rate fiuction PV N PMT FV TAT Page 2 of 4 Droem O w 10V Enable Editing 4. (D Determine the rate for equity using the CAPM Use Note-tand and from CAPM 4 (1) Determine the weight for equity using the DC method Use Notc Sand D, Po 1, from DCF EPS (note 3) $20 M/25M shares EPS growth payout D 4 (1) Average the two Iron average 5. Calculate the WACC the tisual way. Critique your solution. WACC w X FontArt W, X THAT W.Xr. W. w dabartma tothom from west w voila! D Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts