Question: Please Solve it properly and urgently, Do step by step Subject : Mathematical Finance 2. (a) Let W(t) be a Brownian motion. Then, consider the

Please Solve it properly and urgently, Do step by step

Subject : Mathematical Finance

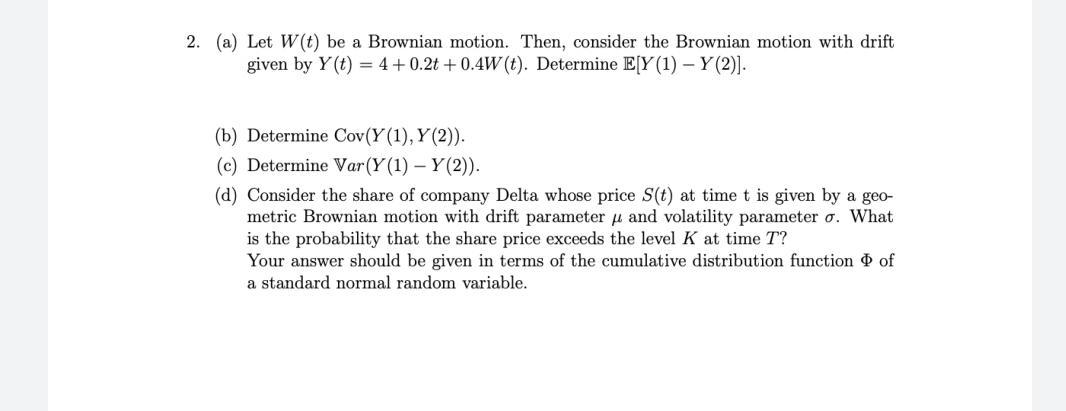

2. (a) Let W(t) be a Brownian motion. Then, consider the Brownian motion with drift given by Y (t) = 4+0.2t +0.4W(t). Determine E[Y (1) - Y(2)). (b) Determine Cov(Y (1), Y (2)). (c) Determine Var(Y (1) - Y(2)). (d) Consider the share of company Delta whose price S(t) at time t is given by a geo- metric Brownian motion with drift parameter y and volatility parameter o. What is the probability that the share price exceeds the level K at time T? Your answer should be given in terms of the cumulative distribution function of a standard normal random variable. 2. (a) Let W(t) be a Brownian motion. Then, consider the Brownian motion with drift given by Y (t) = 4+0.2t +0.4W(t). Determine E[Y (1) - Y(2)). (b) Determine Cov(Y (1), Y (2)). (c) Determine Var(Y (1) - Y(2)). (d) Consider the share of company Delta whose price S(t) at time t is given by a geo- metric Brownian motion with drift parameter y and volatility parameter o. What is the probability that the share price exceeds the level K at time T? Your answer should be given in terms of the cumulative distribution function of a standard normal random variable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts