Question: Please solve it Q4 (25 marks) Below are the financial statement of H, F and Mas at 31 December 2019 Statements of financial position as

Please solve it

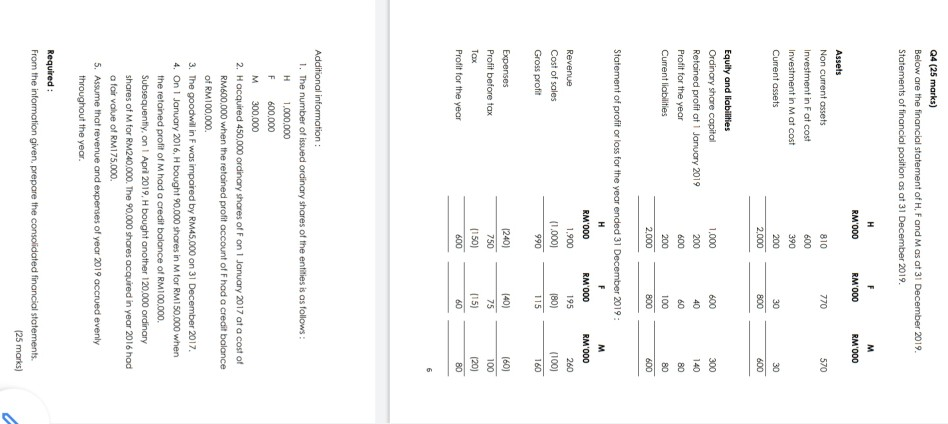

Q4 (25 marks) Below are the financial statement of H, F and Mas at 31 December 2019 Statements of financial position as at 31 December 2019. M H RM'000 F RM'000 RM'000 770 570 Assets Non current assets Investment in Fat cost Investment in Mat cost Current assets 810 600 390 30 30 200 2.000 800 600 600 Equity and liabilities Ordinary share capital Retained profit at 1 January 2019 Profit for the year Current liabilities 1.000 200 40 300 140 80 60 600 200 100 80 2.000 800 800 M Statement of profit or loss for the year ended 31 December 2019: H RM 000 RM'000 Revenue 1.900 195 Cost of sales 11.0001 (80) Gross profit 990 115 RM'000 260 (100) 160 Expenses Profit before tax Profit for the year (240) 750 (150) (40) 75 (15) (60) 100 (20) 80 600 60 H M Additional information: 1. The number of issued ordinary shares of the entities is as follows: 1,000,000 F 600,000 300,000 2. H acquired 450,000 ordinary shares off on 1 January 2017 at a cost of RM600.000 when the retained profit account of Fhad a credit balance of RM100,000 3. The goodwill in F was impaired by RM45.000 on 31 December 2017, 4. On 1 January 2016, H bought 90.000 shares in M for RM 150.000 when the retained profit of Mhad a credit balance of RM100.000 Subsequently, on 1 Apri 2019, H bought another 120.000 ordinary shares of M for RM240.000. The 90.000 shares acquired in year 2016 hod a fair value of RM175.000 5. Assume that revenue and expenses of year 2019 accrued evenly throughout the year. Required: From the information given, prepare the consolidated financial statements. 125 marks) Q4 (25 marks) Below are the financial statement of H, F and Mas at 31 December 2019 Statements of financial position as at 31 December 2019. M H RM'000 F RM'000 RM'000 770 570 Assets Non current assets Investment in Fat cost Investment in Mat cost Current assets 810 600 390 30 30 200 2.000 800 600 600 Equity and liabilities Ordinary share capital Retained profit at 1 January 2019 Profit for the year Current liabilities 1.000 200 40 300 140 80 60 600 200 100 80 2.000 800 800 M Statement of profit or loss for the year ended 31 December 2019: H RM 000 RM'000 Revenue 1.900 195 Cost of sales 11.0001 (80) Gross profit 990 115 RM'000 260 (100) 160 Expenses Profit before tax Profit for the year (240) 750 (150) (40) 75 (15) (60) 100 (20) 80 600 60 H M Additional information: 1. The number of issued ordinary shares of the entities is as follows: 1,000,000 F 600,000 300,000 2. H acquired 450,000 ordinary shares off on 1 January 2017 at a cost of RM600.000 when the retained profit account of Fhad a credit balance of RM100,000 3. The goodwill in F was impaired by RM45.000 on 31 December 2017, 4. On 1 January 2016, H bought 90.000 shares in M for RM 150.000 when the retained profit of Mhad a credit balance of RM100.000 Subsequently, on 1 Apri 2019, H bought another 120.000 ordinary shares of M for RM240.000. The 90.000 shares acquired in year 2016 hod a fair value of RM175.000 5. Assume that revenue and expenses of year 2019 accrued evenly throughout the year. Required: From the information given, prepare the consolidated financial statements. 125 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts