Question: please solve it Question 29 1 pts The common stock of Camry & Co. has a beta of 1.54 and an actual expected return of

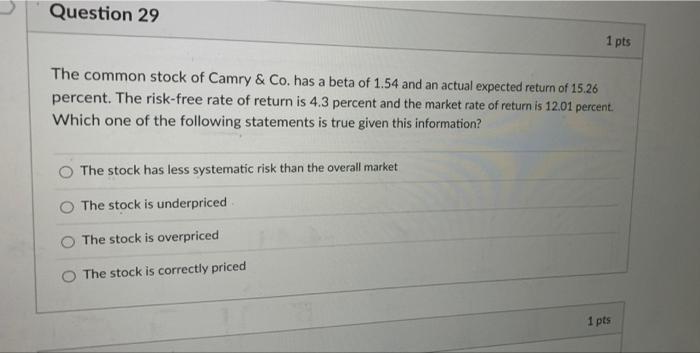

Question 29 1 pts The common stock of Camry & Co. has a beta of 1.54 and an actual expected return of 15.26 percent. The risk-free rate of return is 4.3 percent and the market rate of return is 12.01 percent. Which one of the following statements is true given this information? The stock has less systematic risk than the overall market The stock is underpriced The stock is overpriced O The stock is correctly priced 1 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts