Question: please solve it Question1: bank reconciliation statement RED TECH developed the following information in recording its bank statement for the month of March. Balance per

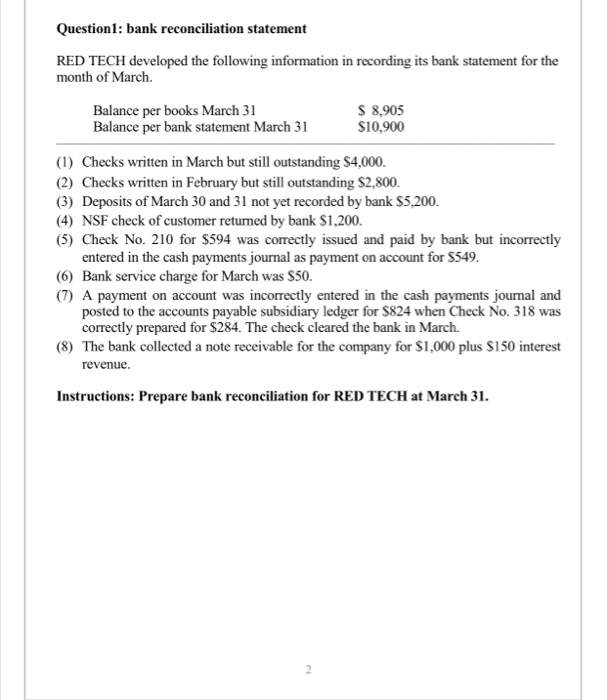

Question1: bank reconciliation statement RED TECH developed the following information in recording its bank statement for the month of March. Balance per books March 31 Balance per bank statement March 31 $ 8,905 $10.900 (1) Checks written in March but still outstanding $4,000. (2) Checks written in February but still outstanding $2,800. (3) Deposits of March 30 and 31 not yet recorded by bank $5,200. (4) NSF check of customer returned by bank $1,200. (5) Check No. 210 for $594 was correctly issued and paid by bank but incorrectly entered in the cash payments journal as payment on account for $549. (6) Bank service charge for March was $50. (7) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared the bank in March. (8) The bank collected a note receivable for the company for $1,000 plus $150 interest revenue. Instructions: Prepare bank reconciliation for RED TECH at March 31. Solution RED TECH Bank Reconciliation March 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts