Question: Please solve it quickly and in docx format. Thank you! You are 28 years old and currently making $140,000 per year. Your salary grows at

Please solve it quickly and in docx format. Thank you!

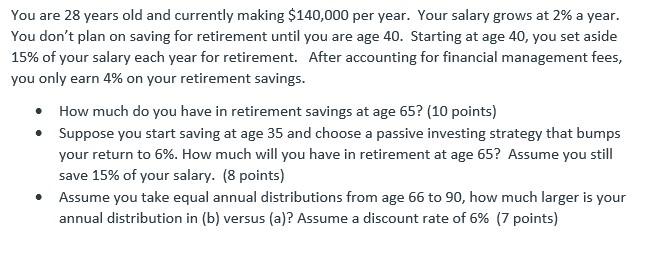

You are 28 years old and currently making $140,000 per year. Your salary grows at 2% a year. You don't plan on saving for retirement until you are age 40. Starting at age 40, you set aside 15% of your salary each year for retirement. After accounting for financial management fees, you only earn 4% on your retirement savings. How much do you have in retirement savings at age 65? (10 points) Suppose you start saving at age 35 and choose a passive investing strategy that bumps your return to 6%. How much will you have in retirement at age 65? Assume you still save 15% of your salary. (8 points) Assume you take equal annual distributions from age 66 to 90, how much larger is your annual distribution in (b) versus (a)? Assume a discount rate of 6% (7 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts