Question: Please solve it quickly, time expires in an hour from now Using the following items for Disney Operating Income $54000 Loss on early retirement of

Please solve it quickly, time expires in an hour from now

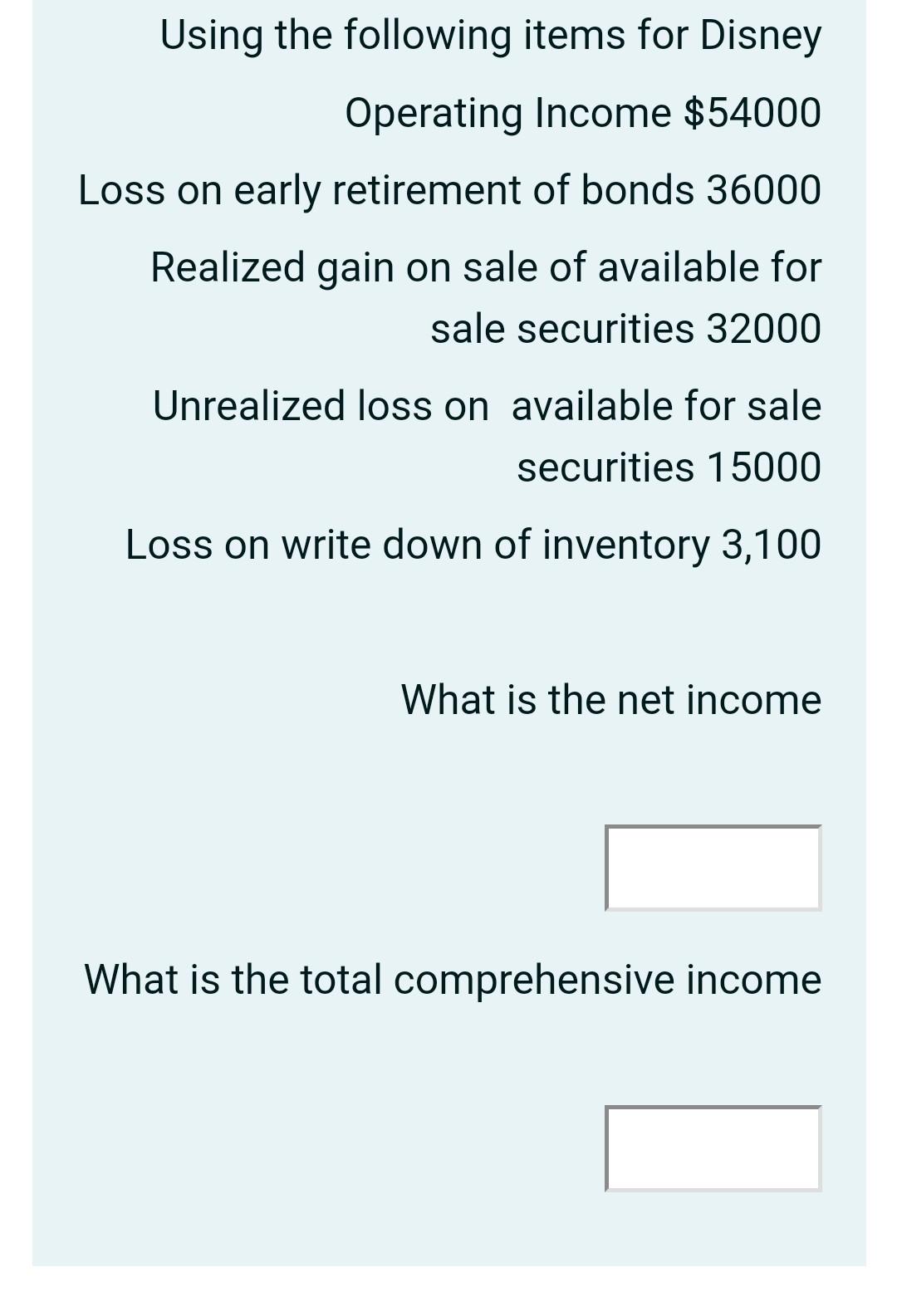

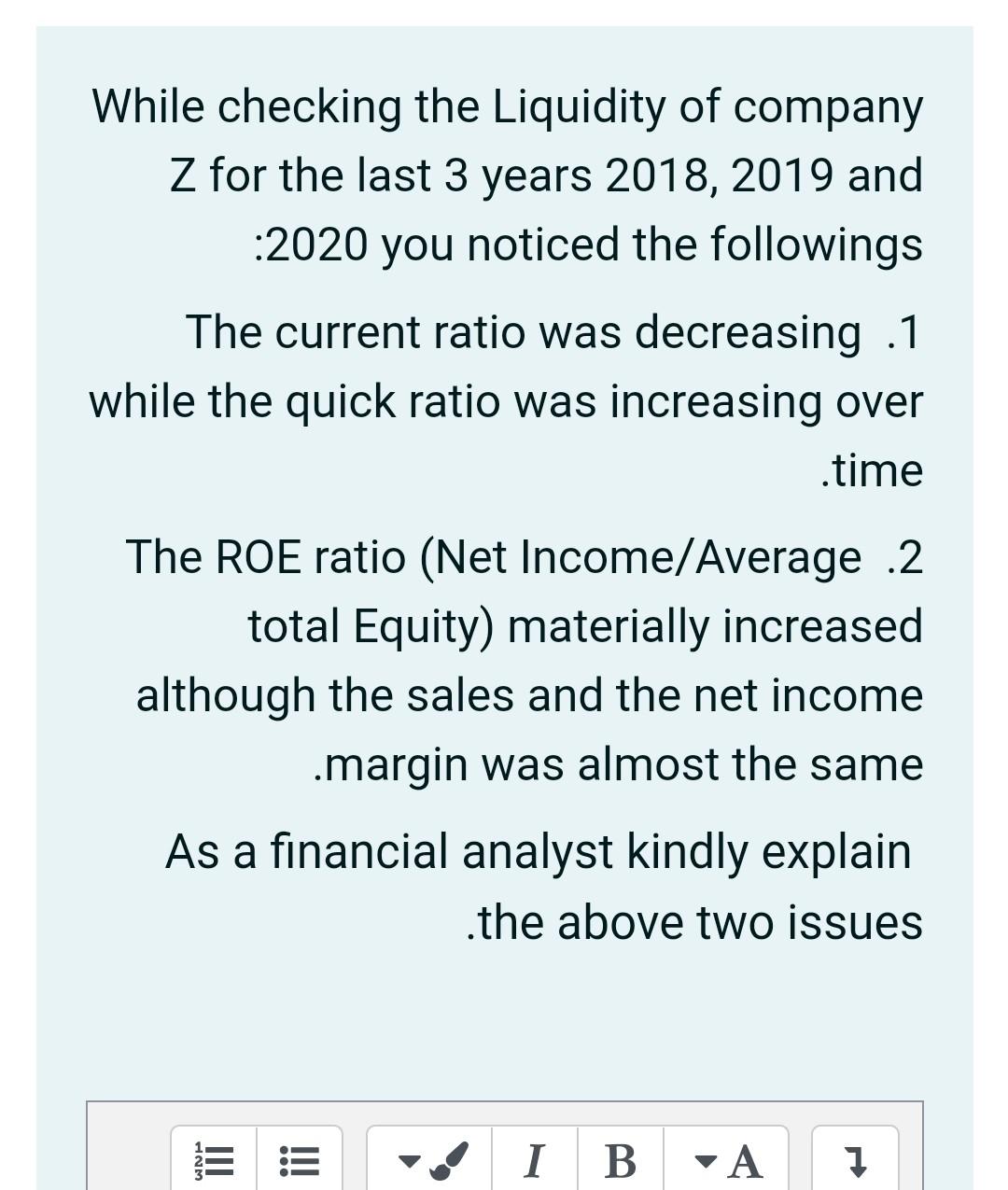

Using the following items for Disney Operating Income $54000 Loss on early retirement of bonds 36000 Realized gain on sale of available for sale securities 32000 Unrealized loss on available for sale securities 15000 Loss on write down of inventory 3,100 What is the net income What is the total comprehensive income While checking the Liquidity of company Z for the last 3 years 2018, 2019 and :2020 you noticed the followings The current ratio was decreasing .1 while the quick ratio was increasing over .time The ROE ratio (Net Income/Average 2 total Equity) materially increased although the sales and the net income .margin was almost the same As a financial analyst kindly explain .the above two issues UN III = I B A 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts