Question: please solve it ryt i m sharing my factor table too Ivanhoe Company is considering a long-term investment project called ZIP. ZIP will require an

please solve it ryt i m sharing my factor table too

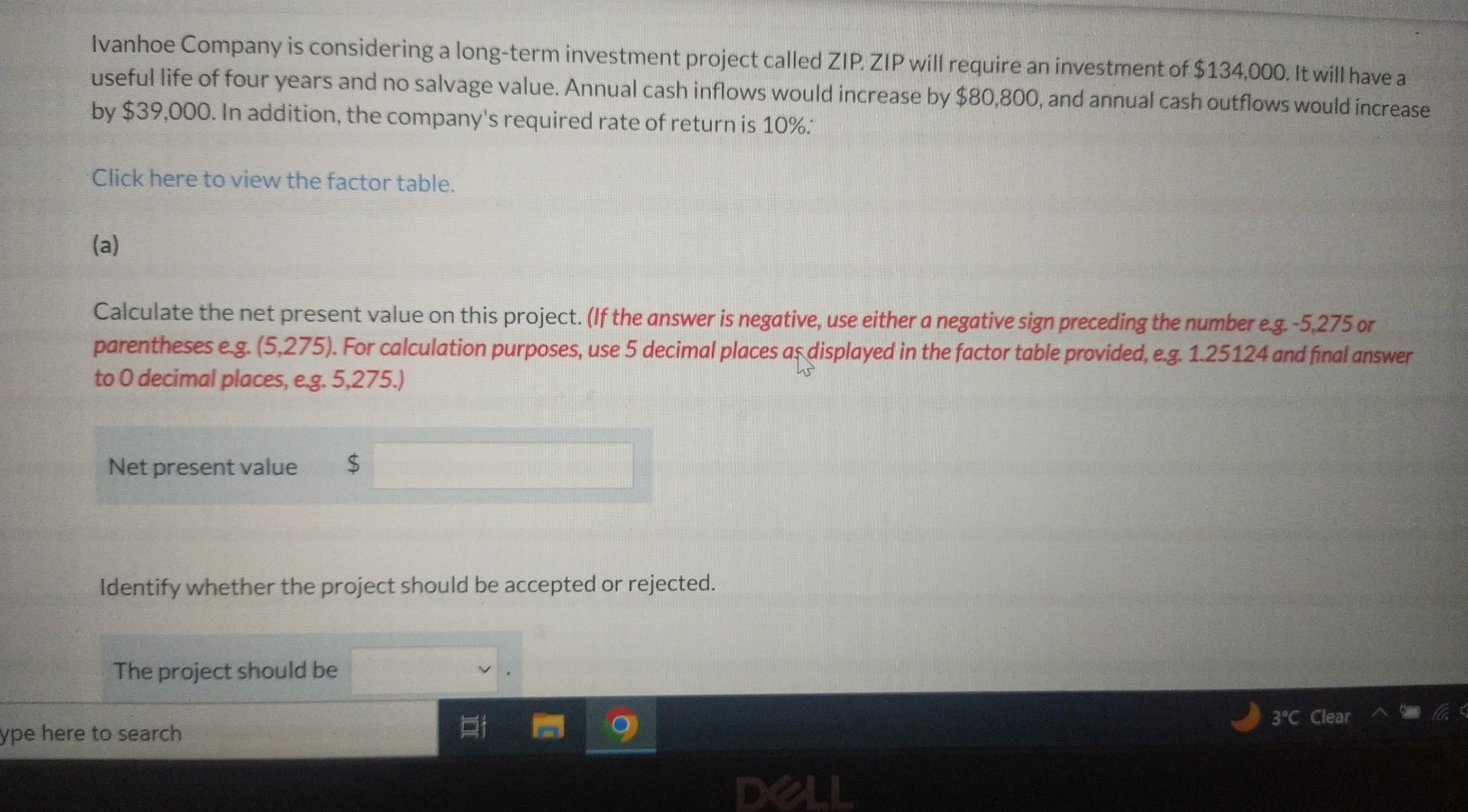

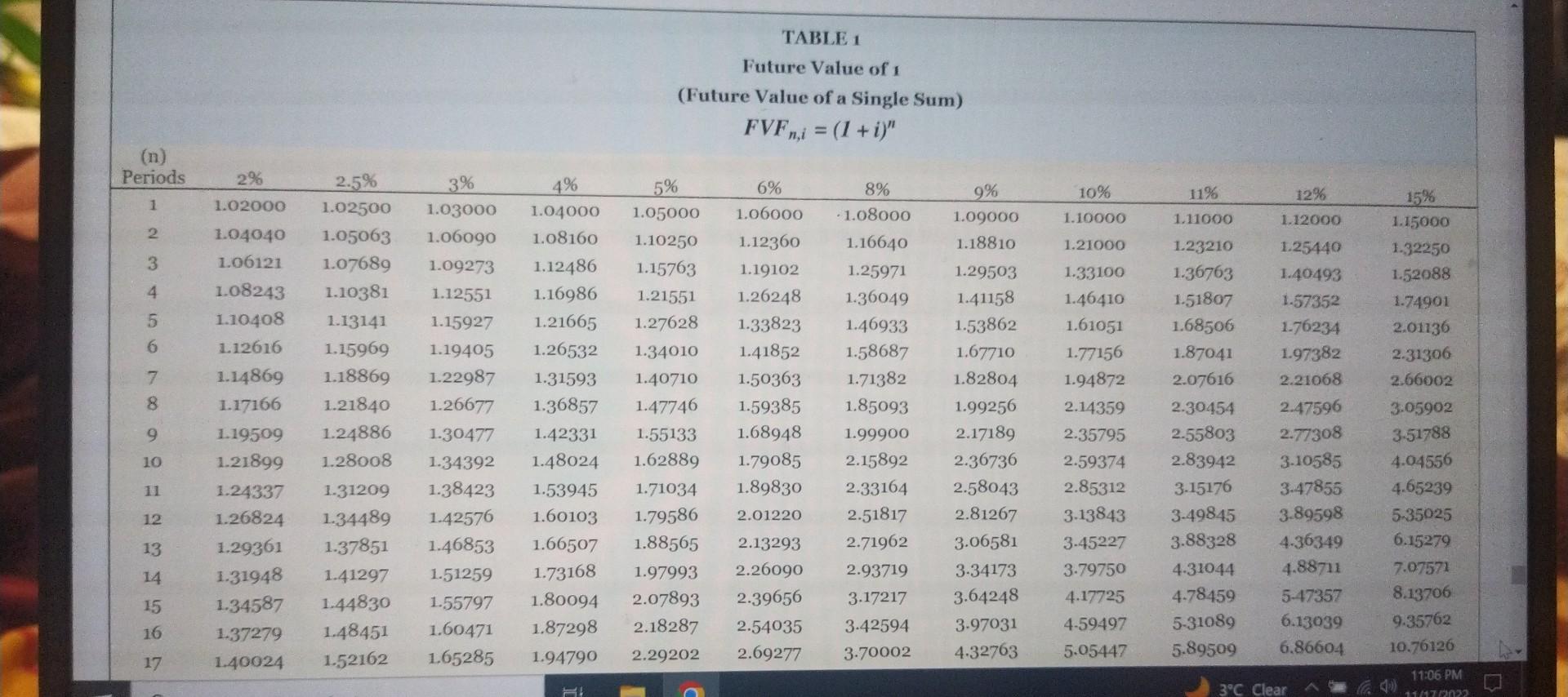

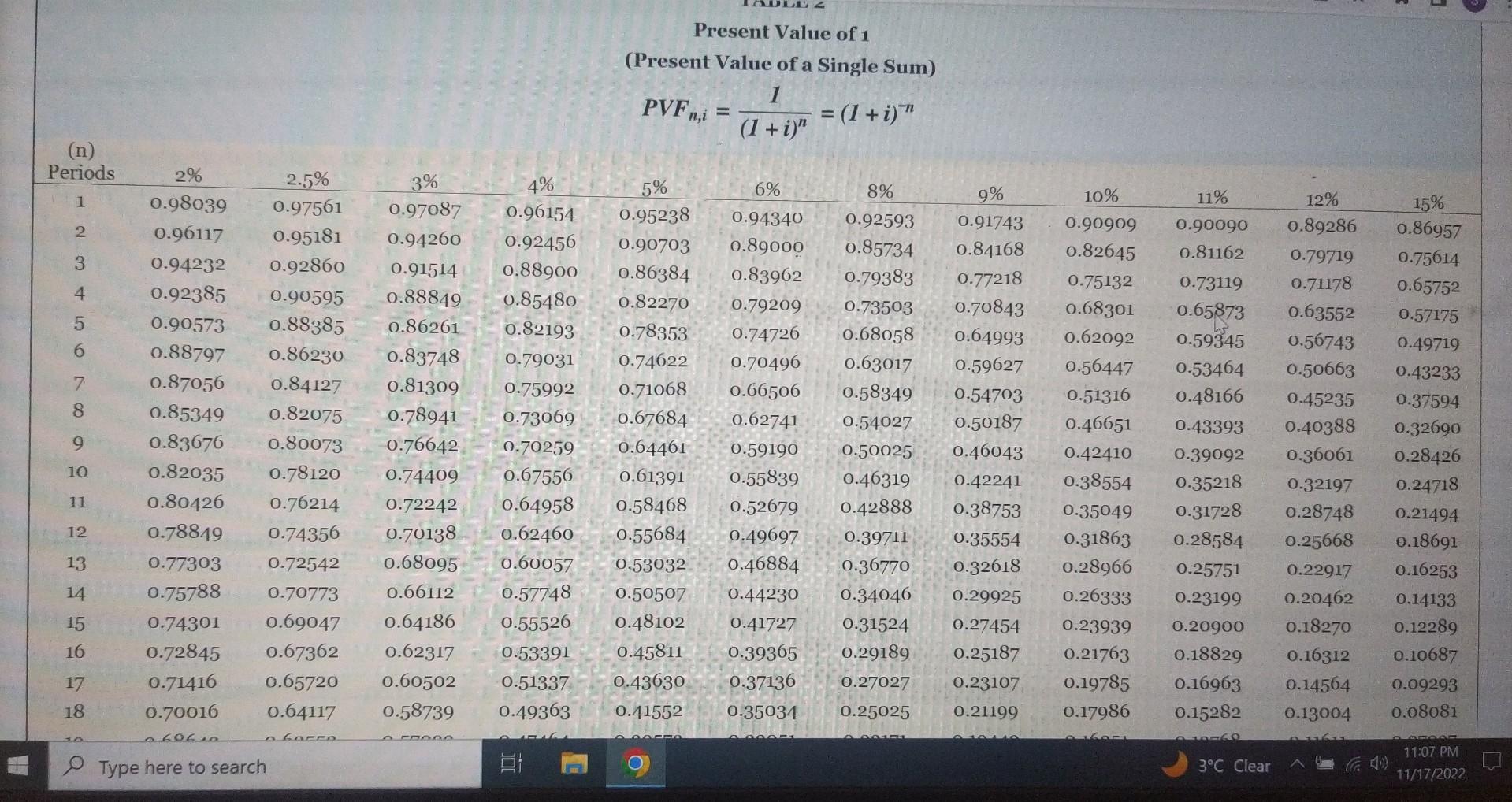

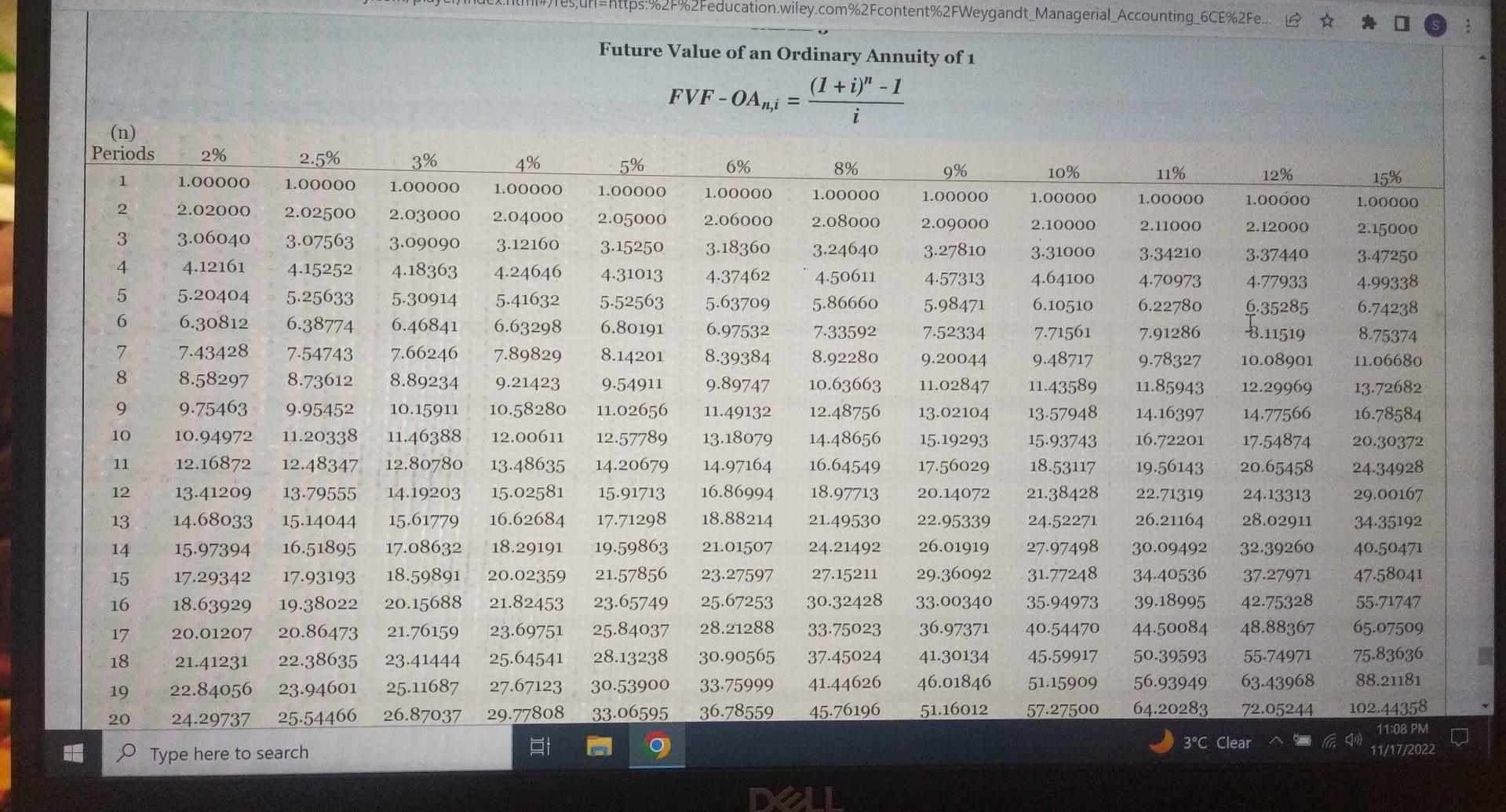

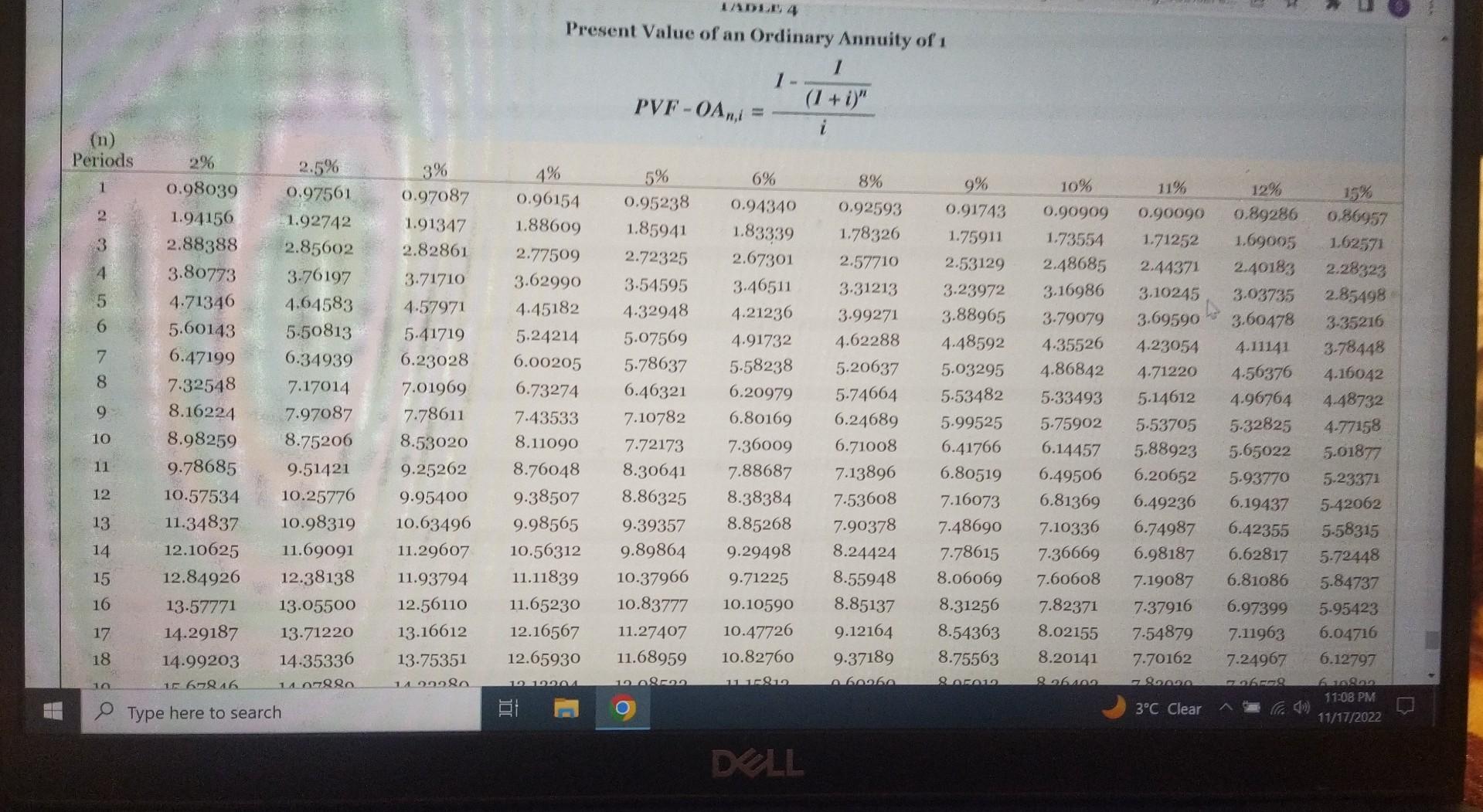

Ivanhoe Company is considering a long-term investment project called ZIP. ZIP will require an investment of $134,000. It will have a useful life of four years and no salvage value. Annual cash inflows would increase by $80,800, and annual cash outflows would increase by $39,000. In addition, the company's required rate of return is 10% : Click here to view the factor table. (a) Calculate the net present value on this project. (If the answer is negative, use either a negative sign preceding the number eg. 5,275 or parentheses e.g. (5,275). For calculation purposes, use 5 decimal places a. displayed in the factor table provided, e.g. 1.25124 and final answer to 0 decimal places, e.g. 5,275.) Net present value $ Identify whether the project should be accepted or rejected. Identiry wnetner tne project snoula de acceptea or rejectea. The project should be (b) Calculate the internal rate of return on this project. (Round answer to 1 decimal place, e.g. 5.2\%) Internal rate of return Identify whether the project should be accepted or rejected. TABLE 1 Future Value of 1 (Future Value of a Single Sum) FVFn,i=(I+i)n (n) Present Value of 1 (Present Value of a Single Sum) PVFn,i=(1+i)n1=(1+i)n Future Value of an Ordinary Annuity of 1 FVFOAn,i=i(1+i)n1 Present Value of an Ordinary Annuity of 1 PVFOAn,i=i1(1+i)n1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts