Question: please solve it step by step thx 20. Export Bank has a trading position in Japanese yen () and Swiss francs (SFr). At the close

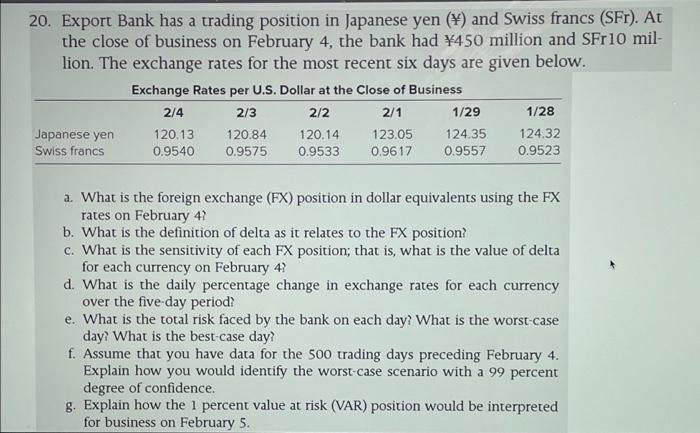

20. Export Bank has a trading position in Japanese yen () and Swiss francs (SFr). At the close of business on February 4, the bank had 450 million and SFr10 mil- lion. The exchange rates for the most recent six days are given below. Exchange Rates per U.S. Dollar at the Close of Business 2/4 2/3 2/2 2/1 1/29 1/28 Japanese yen 120.13 120.84 120.14 123.05 124.35 124.32 Swiss francs 0.9540 0.9575 0.9533 0.9617 0.9557 0.9523 a. What is the foreign exchange (FX) position in dollar equivalents using the FX rates on February 4? b. What is the definition of delta as it relates to the FX position? c. What is the sensitivity of each FX position, that is, what is the value of delta for each currency on February 4? d. What is the daily percentage change in exchange rates for each currency over the five-day period? e. What is the total risk faced by the bank on each day? What is the worst-case day? What is the best-case day? f. Assume that you have data for the 500 trading days preceding February 4. Explain how you would identify the worst-case scenario with a 99 percent degree of confidence. g. Explain how the 1 percent value at risk (VAR) position would be interpreted for business on February 5. a. What is the foreign exchange (FX) position in dollar equivalents using the FX rates on February 4? b. What is the definition of delta as it relates to the FX position? c. What is the sensitivity of each FX position; that is, what is the value of delta for each currency on February 4? d. What is the daily percentage change in exchange rates for each currency over the five-day period? e. What is the total risk faced by the bank on each day? What is the worst-case day? What is the best-case day? f. Assume that you have data for the 500 trading days preceding February 4. Explain how you would identify the worst-case scenario with a 99 percent degree of confidence. g. Explain how the 1 percent value at risk (VAR) position would be interpreted for business on February 5. h. How would the simulation change at the end of the day on February 5? What variables and/or processes in the analysis may change? What variables and/or processes will not change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts