Question: Please solve it using excel spreadsheet(functions), and provide the complete solution Consider the following EOY cash flows for two mutually exclusive alternatives battery systems (one

Please solve it using excel spreadsheet(functions), and provide the complete solution

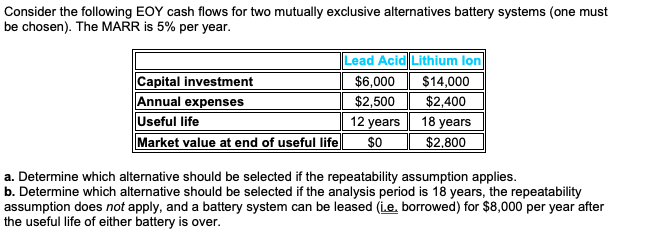

Consider the following EOY cash flows for two mutually exclusive alternatives battery systems (one must be chosen). The MARR is 5% per year. Lead Acid Lithium Ion Capital investment $6,000 $14,000 Annual expenses $2,500 $2,400 Useful life 12 years 18 years Market value at end of useful life $0 $2,800 a. Determine which alternative should be selected if the repeatability assumption applies. b. Determine which alternative should be selected if the analysis period is 18 years, the repeatability assumption does not apply, and a battery system can be leased (le borrowed) for $8,000 per year after the useful life of either battery is over. Consider the following EOY cash flows for two mutually exclusive alternatives battery systems (one must be chosen). The MARR is 5% per year. Lead Acid Lithium Ion Capital investment $6,000 $14,000 Annual expenses $2,500 $2,400 Useful life 12 years 18 years Market value at end of useful life $0 $2,800 a. Determine which alternative should be selected if the repeatability assumption applies. b. Determine which alternative should be selected if the analysis period is 18 years, the repeatability assumption does not apply, and a battery system can be leased (le borrowed) for $8,000 per year after the useful life of either battery is over

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts