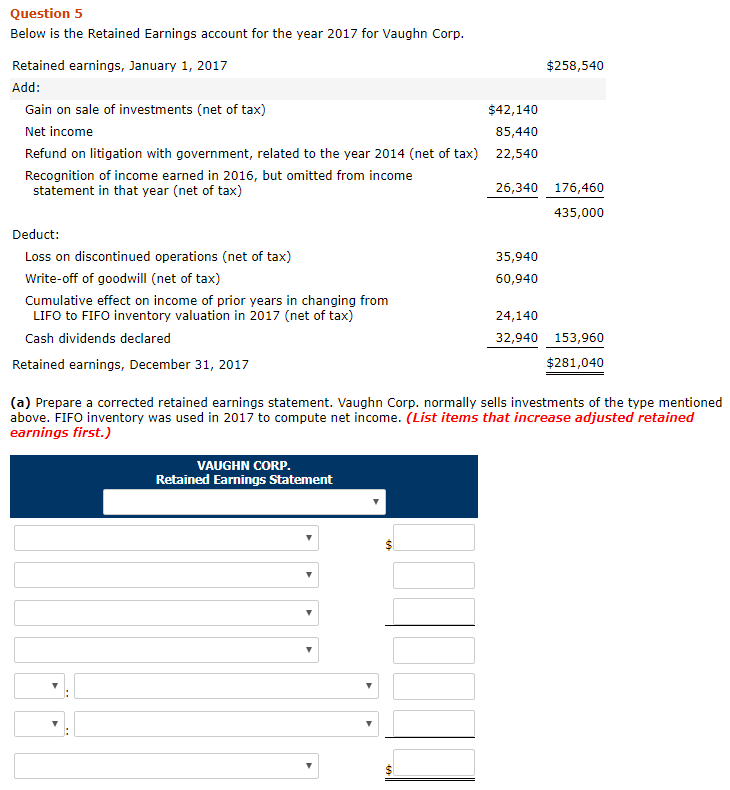

Question: Please solve it using technology. Question 5 Below is the Retained Earnings account for the year 2017 for Vaughn Corp Retained earnings, January 1, 2017

Please solve it using technology.

Question 5 Below is the Retained Earnings account for the year 2017 for Vaughn Corp Retained earnings, January 1, 2017 Add: $258,540 Gain on sale of investments (net of tax) Net income Refund on litigation with government, related to the year 2014 (net of tax) Recognition of income earned in 2016, but omitted from income $42,140 85,440 22,540 statement in that year (net of tax) 26,340 176,460 435,000 Deduct: Loss on discontinued operations (net of tax) Write-off of goodwill (net of tax) Cumulative effect on income of prior years in changing from 35,940 60,940 LIFO to FIFO inventory valuation in 2017 (net of tax) 24,140 32,940 153,960 Cash dividends declared Retained earnings, December 31, 2017 $281,040 (a) Prepare a corrected retained earnings statement. Vaughn Corp. normally sells investments of the type mentioned above. FIFO inventory was used in 2017 to compute net income. (List items that increase adjusted retained earnings first.) VAUGHN CORP Retained Earnings Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts