Question: please solve it with specific steps thanks QUESTION 1 Assume that the spot price of gold is 1,787.76, and the 6.22-year treasury yield is 3.16%,

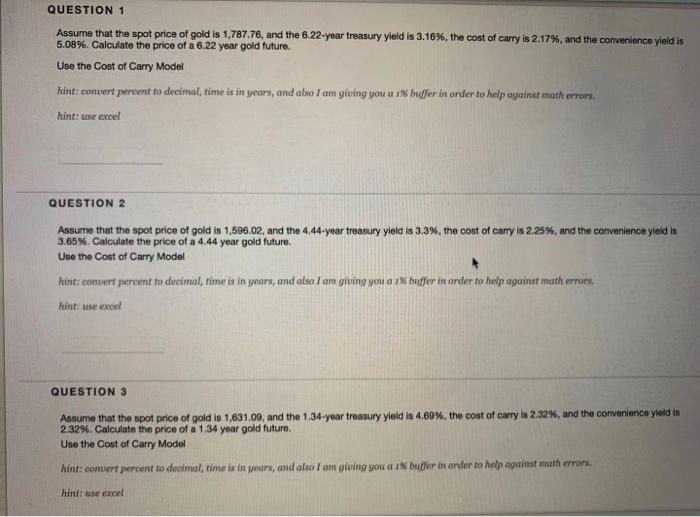

QUESTION 1 Assume that the spot price of gold is 1,787.76, and the 6.22-year treasury yield is 3.16%, the cost of carry is 2.17%, and the convenience yield is 5.08%. Calculate the price of a 6.22 year gold future. Use the cost of Carry Model hint: convert prevent to decimal, time is in years, and also I am giving you a 1% buffer in order to help against math errors. hint: use excel QUESTION 2 Assume that the spot price of gold is 1,596.02, and the 4.44-year treasury yleld is 3.3%, the cost of carry is 2.25%, and the convenience yield is 3.65%. Calculate the price of a 4.44 year gold future. Use the cost of Carry Model hint: comert percent to decimal, time is in years, and also I am giving you a 14 buffer in order to help against math errors. hint: use excel QUESTION 3 Assume that the spot price of gold is 1,631,09, and the 1.34-year treasury yleld is 4.69%, the cost of carry is 2.32%, and the convenience yield is 2.32%. Calculate the price of a 1.34 year gold future. Use the cost of Carry Model hint: convert percent to decimal, time is in years, and also I am giving you a buffer in order to help against math errors hint: use excel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts