Question: please solve it without excel Q1) Fox Corporation is considering the purchase of a $500,000 a software system. It will depreciated straight line to zero

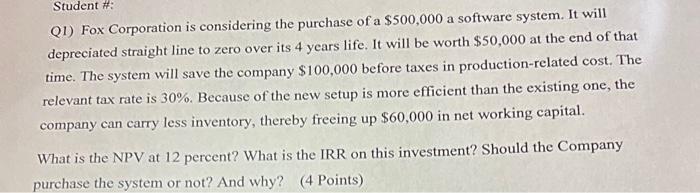

Q1) Fox Corporation is considering the purchase of a $500,000 a software system. It will depreciated straight line to zero over its 4 years life. It will be worth $50,000 at the end of that time. The system will save the company $100,000 before taxes in production-related cost. The relevant tax rate is 30%. Because of the new setup is more efficient than the existing one, the company can carry less inventory, thereby freeing up $60,000 in net working capital. What is the NPV at 12 percent? What is the IRR on this investment? Should the Company purchase the system or not? And why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts