Question: Please solve it without using EXCEL Assume that the risk-free rate is 5%, the expected market return is 11%, and beta of IBM is 0.9.

Please solve it without using EXCEL

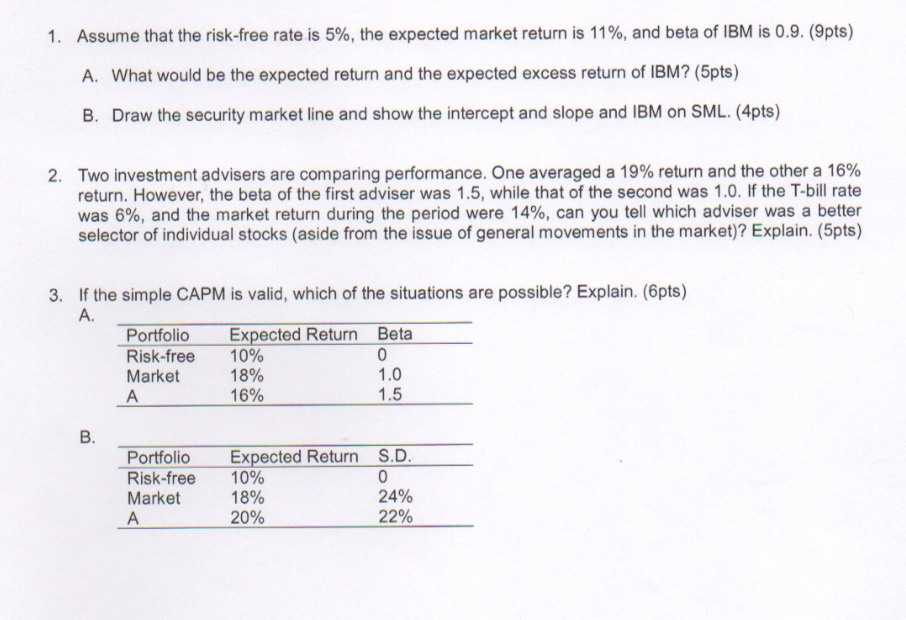

Assume that the risk-free rate is 5%, the expected market return is 11%, and beta of IBM is 0.9. (9pts) A. What would be the expected return and the expected excess return of IBM? (5pts) B. Draw the security market line and show the intercept and slope and IBM on SML. (4pts) 1. Two investment advisers are comparing performance. One averaged a 19% return and the other a 16% return. However, the beta of the first adviser was 1.5, while that of the second was 1.0. If the T-bill rate was 6%, and the market return during the period were 14%, can you tell which adviser was a better selector of individual stocks (aside from the issue of general movements in the market)? Explain. (5pts) 2. If the simple CAPM is valid, which of the situations are possible? Explain. (6pts) A. 3. Expected Return 10% 18% 16% Beta Portfolio Risk-free Market 1.5 Expected Return 10% 18% 20% S.D Portfolio Risk-free Market 28% 22%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts