Question: Please solve manually, no Excel. An organization is considering the purchase of new machines to automatically conduct some quality control tasks. The machines are expected

Please solve manually, no Excel.

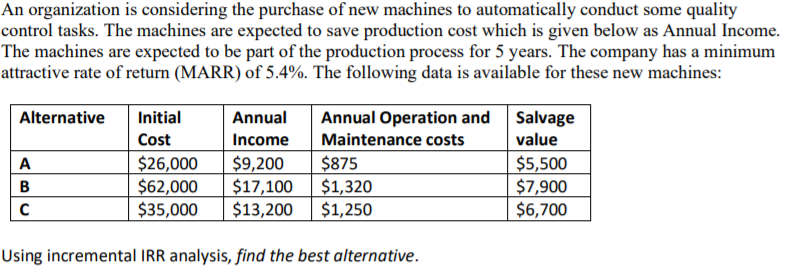

An organization is considering the purchase of new machines to automatically conduct some quality control tasks. The machines are expected to save production cost which is given below as Annual Income. The machines are expected to be part of the production process for 5 years. The company has a minimum attractive rate of return (MARR) of 5.4%. The following data is available for these new machines: Alternative A B Initial Cost $26,000 $62,000 $35,000 Annual Income $9,200 $17,100 $13,200 Annual Operation and Maintenance costs $875 $1,320 $1,250 Salvage value $5,500 $7,900 $6,700 Using incremental IRR analysis, find the best alternative. An organization is considering the purchase of new machines to automatically conduct some quality control tasks. The machines are expected to save production cost which is given below as Annual Income. The machines are expected to be part of the production process for 5 years. The company has a minimum attractive rate of return (MARR) of 5.4%. The following data is available for these new machines: Alternative A B Initial Cost $26,000 $62,000 $35,000 Annual Income $9,200 $17,100 $13,200 Annual Operation and Maintenance costs $875 $1,320 $1,250 Salvage value $5,500 $7,900 $6,700 Using incremental IRR analysis, find the best alternative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts