Question: please solve MSU Case: Below is the December 31, 2012 balance sheet for MSU Corporation as well as a narrative of transactions that occurred during

please solve

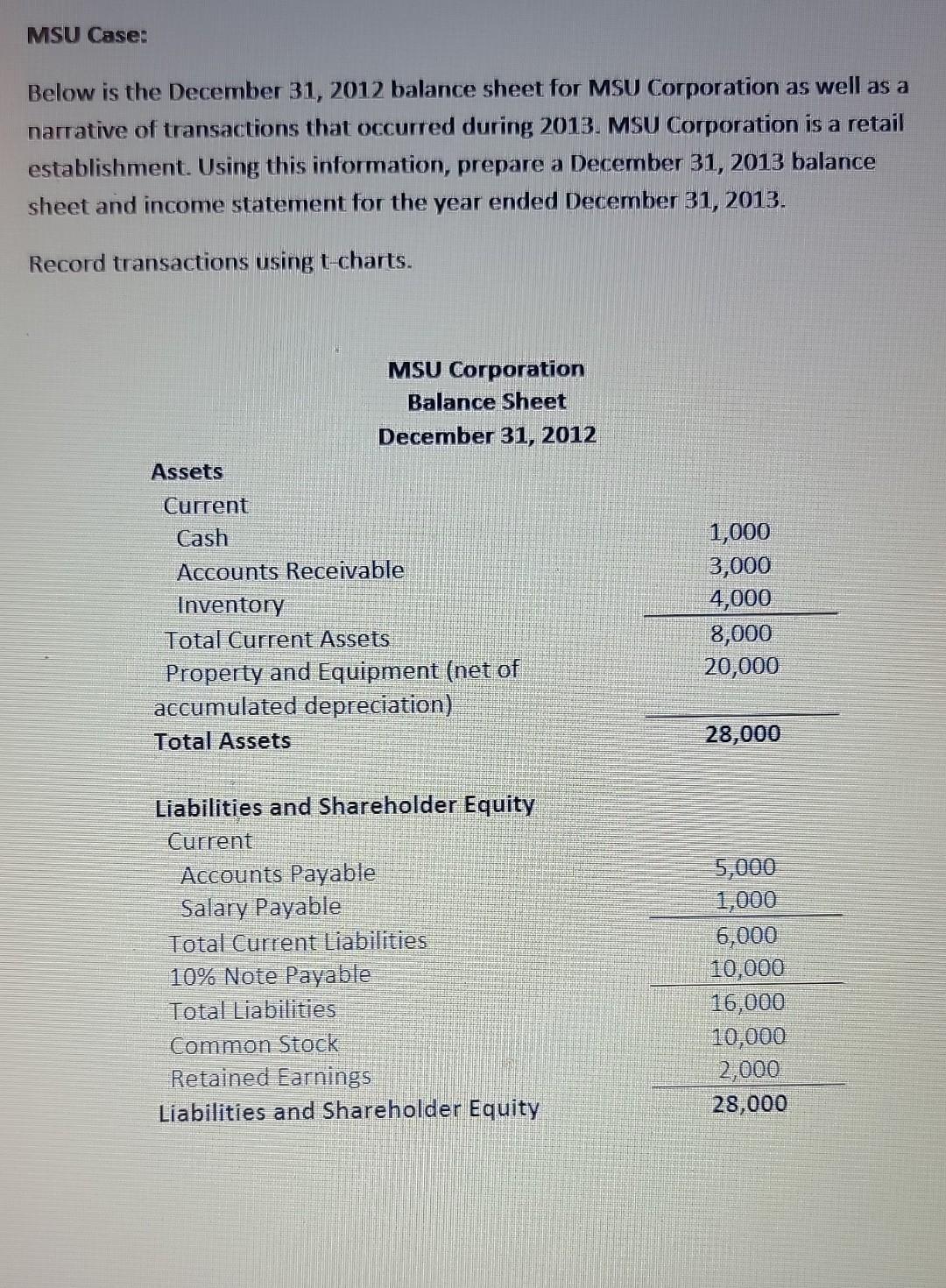

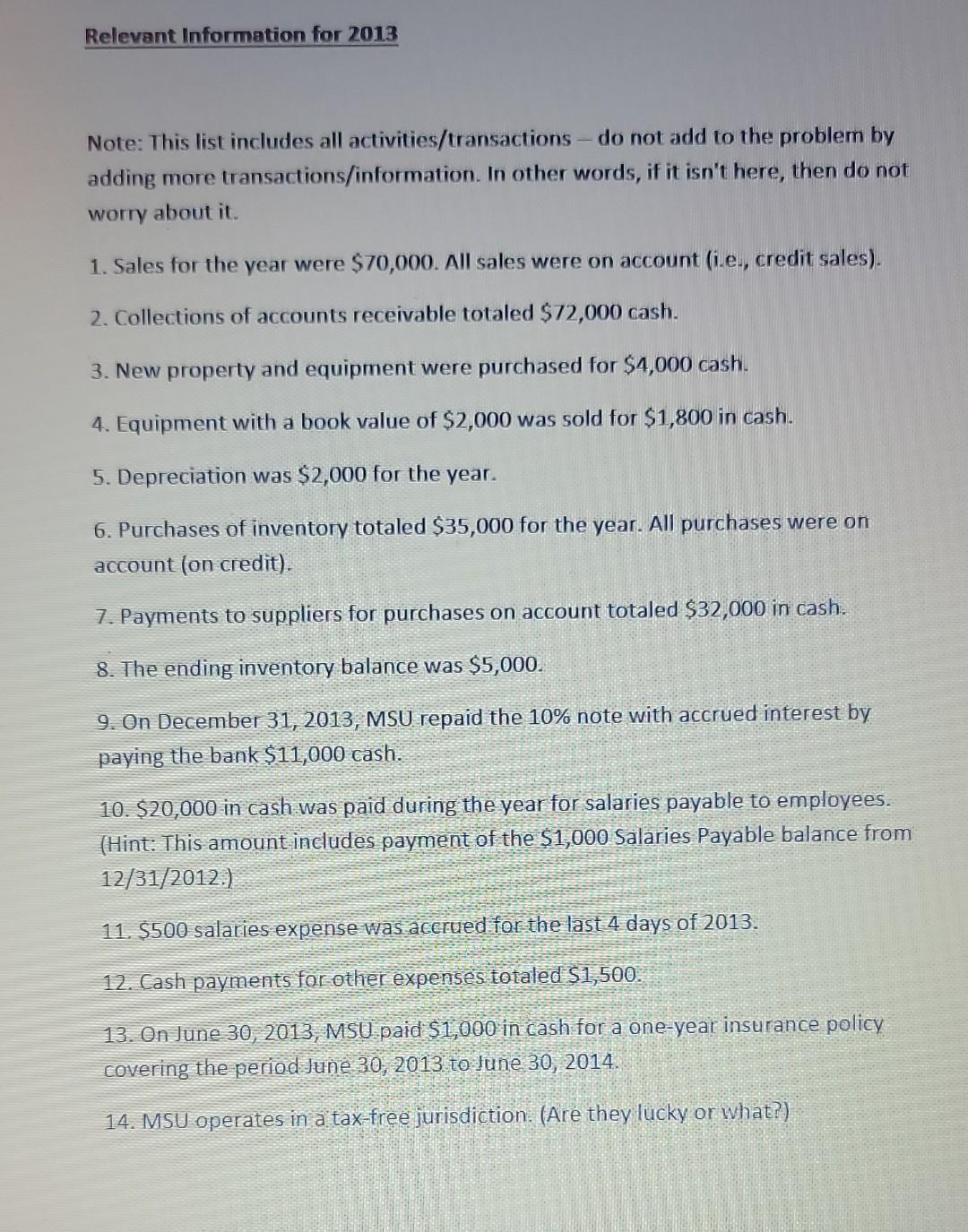

MSU Case: Below is the December 31, 2012 balance sheet for MSU Corporation as well as a narrative of transactions that occurred during 2013. MSU Corporation is a retail establishment. Using this information, prepare a December 31, 2013 balance sheet and income statement for the year ended December 31, 2013. Record transactions using t-charts. Relevant Information for 2013 Note: This list includes all activities/transactions - do not add to the problem by adding more transactions/information. In other words, if it isn't here, then do not worry about it. 1. Sales for the year were $70,000. All sales were on account (i.e., credit sales). 2. Collections of accounts receivable totaled $72,000 cash. 3. New property and equipment were purchased for $4,000 cash. 4. Equipment with a book value of $2,000 was sold for $1,800 in cash. 5. Depreciation was $2,000 for the year. 6. Purchases of inventory totaled $35,000 for the year. All purchases were on account (on credit). 7. Payments to suppliers for purchases on account totaled $32,000 in cash. 8. The ending inventory balance was $5,000. 9. On December 31,2013 , MSU repaid the 10% note with accrued interest by paying the bank $11,000 cash. 10. $20,000 in cash was paid during the year for salaries payable to employees. (Hint: This amount includes payment of the $1,000 Salaries Payable balance from 12/31/2012.) 11. $500 salaries expense was acerued for the last 4 days of 2013. 12. Cash payments for other expenses totaled S1,500 13. On June 30,2013, MSU paid 51,000 in cash for a one-year insurance policy covering the period tene 30,2013 to lune 30,2014. 14. MSU operates in a tax-free jurisdiction. (Are they lucky or what?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts