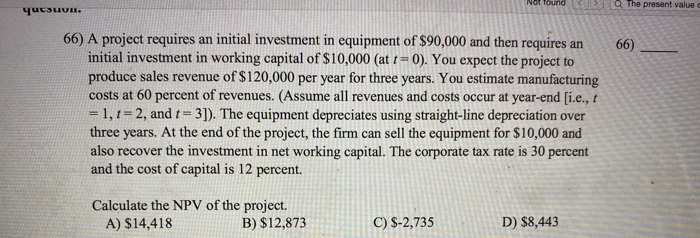

Question: Please solve Not found . The present value qucsuu 6 6) 66) A project requires an initial investment in equipment of $90,000 and then requires

Not found . The present value qucsuu 6 6) 66) A project requires an initial investment in equipment of $90,000 and then requires an initial investment in working capital of $10,000 (at 1 = 0). You expect the project to produce sales revenue of $120,000 per year for three years. You estimate manufacturing costs at 60 percent of revenues. (Assume all revenues and costs occur at year-end [i.e., 1 -1,1=2, and t - 3]). The equipment depreciates using straight-line depreciation over three years. At the end of the project, the firm can sell the equipment for $10,000 and also recover the investment in net working capital. The corporate tax rate is 30 percent and the cost of capital is 12 percent. Calculate the NPV of the project. A) $14,418 B) $12,873 C) $-2,735 D) $8,443

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts