Question: Please solve NOT using excel. Alphas and Reward to Risk Ratios The S&P500 expected return is 20% and 3 Month T-bill rate is 1% currently.

Please solve NOT using excel.

Please solve NOT using excel.

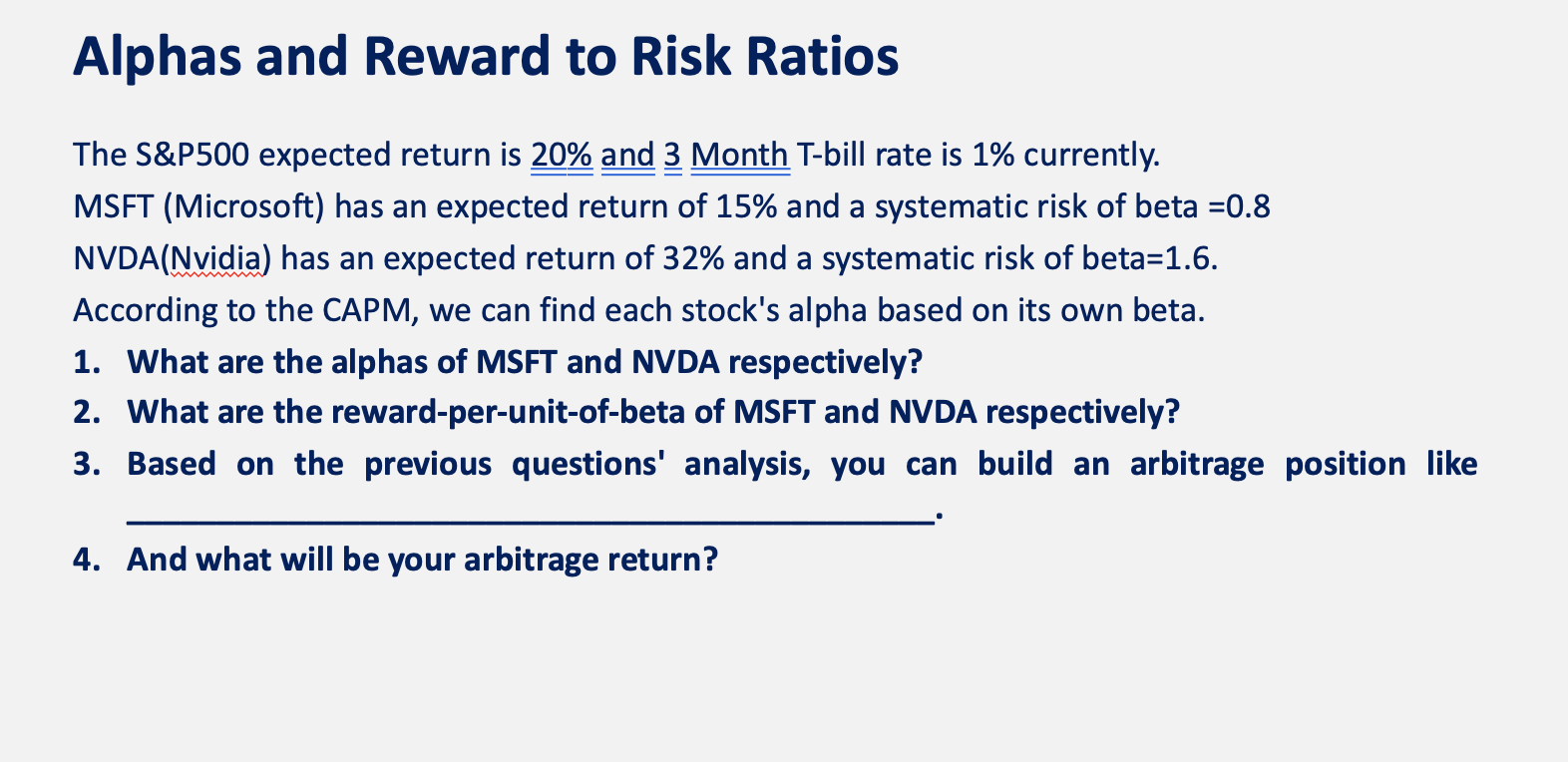

Alphas and Reward to Risk Ratios The S&P500 expected return is 20% and 3 Month T-bill rate is 1% currently. MSFT (Microsoft) has an expected return of 15% and a systematic risk of beta =0.8 NVDA(Nvidia) has an expected return of 32% and a systematic risk of beta=1.6. According to the CAPM, we can find each stock's alpha based on its own beta. 1. What are the alphas of MSFT and NVDA respectively? 2. What are the reward-per-unit-of-beta of MSFT and NVDA respectively? 3. Based on the previous questions' analysis, you can build an arbitrage position like 4. And what will be your arbitrage return? Alphas and Reward to Risk Ratios The S&P500 expected return is 20% and 3 Month T-bill rate is 1% currently. MSFT (Microsoft) has an expected return of 15% and a systematic risk of beta =0.8 NVDA(Nvidia) has an expected return of 32% and a systematic risk of beta=1.6. According to the CAPM, we can find each stock's alpha based on its own beta. 1. What are the alphas of MSFT and NVDA respectively? 2. What are the reward-per-unit-of-beta of MSFT and NVDA respectively? 3. Based on the previous questions' analysis, you can build an arbitrage position like 4. And what will be your arbitrage return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts