Question: Please solve on the partial answer and show your working, thank you Question 2: Preparation and Presentation of the Income Statement Dinky Drop Electronics Limited

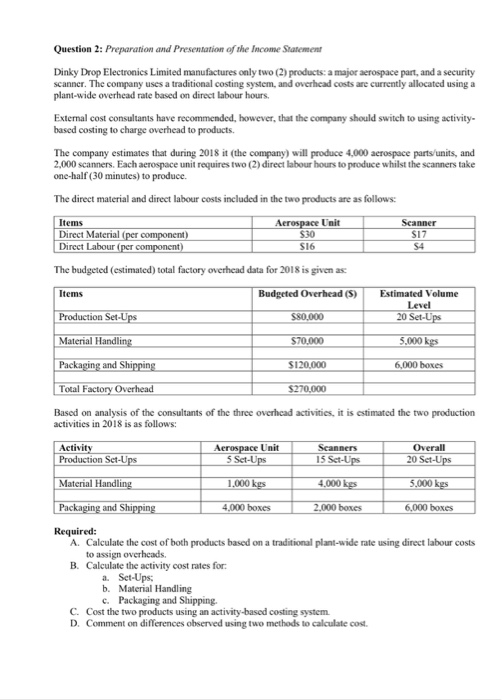

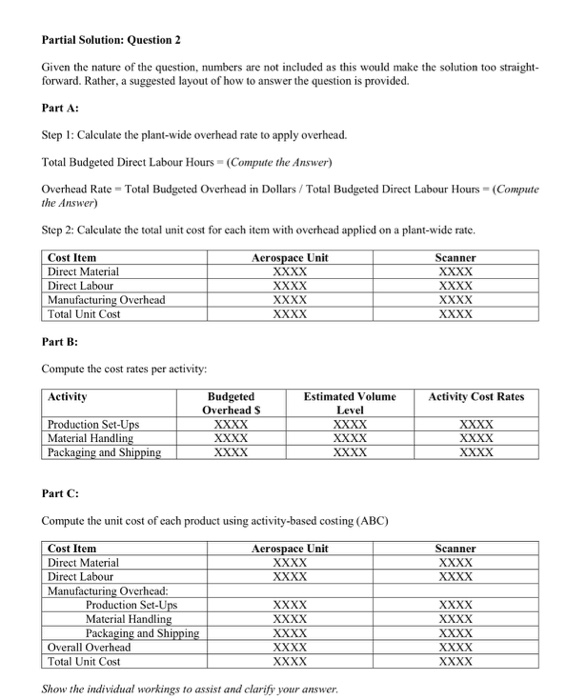

Question 2: Preparation and Presentation of the Income Statement Dinky Drop Electronics Limited manufactures only two (2) products: a major aerospace part, and a security scanner. The company uses a traditional costing system, and overhcad costs are currently allocated using a plant-wide overhead rate based on direct labour hours. External cost consultants have recommended, however, that the company should switch to using activity- based costing to charge overhead to products. The company estimates that during 2018 it (the company) will produce 4,000 acrospace parts units, and 2,000 scanners. Each aerospace unit requires two (2) direct labour hours to produce whilst the scanners take one-half (30 minutes) to produce. The direct material and direct labour costs included in the two products are as follows: Items Direct Material Direct Labour Aerospace Unit $30 S16 S17 S4 The budgeted (estimated) total factory overhead data for 2018 is given as Items Production Set-U Material Handli Budgeted Overhead (S) $80,000 $70,000 $120,000 Estimated Volume Level 20 Set-U 5,000 k and 6,000 boxes Total Factory Overhead Based on analysis of the consultants of the three overhcad activities, it is estimated the two production activities in 2018 is as follows: Activit Production Set-U Aerospace Unit Overall 20 Set-U 5 Set-U 15 Sct-U Material 4,000 and 4,000 boxeS boxes 6,000 boxes Calculate the cost of both products based on a traditional plant-wide rate using direct labour costs to assign overheads. Calculate the activity cost rates for: A. B. a. Set-Ups b. Material Handling C. D. c. Packaging and Shipping. Cost the two products using an activity-based costing systemm Comment on differences observed using two methods to calculate cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts