Question: please solve only 2nd and 3rd part in 40 minutes please urgently... I'll give you up thumb definitely a) A stock is currently traded at

please solve only 2nd and 3rd part in 40 minutes please urgently... I'll give you up thumb definitely

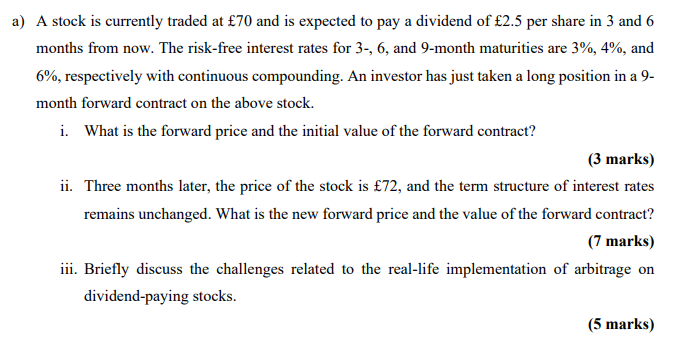

a) A stock is currently traded at 70 and is expected to pay a dividend of 2.5 per share in 3 and 6 months from now. The risk-free interest rates for 3-, 6, and 9-month maturities are 3%, 4%, and 6%, respectively with continuous compounding. An investor has just taken a long position in a 9- month forward contract on the above stock. i. What is the forward price and the initial value of the forward contract? (3 marks) ii. Three months later, the price of the stock is 72, and the term structure of interest rates remains unchanged. What is the new forward price and the value of the forward contract? (7 marks) iii. Briefly discuss the challenges related to the real-life implementation of arbitrage on dividend-paying stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts