Question: please solve only question 3 , 4 and 5 chilotions, andiyze the solvency and the liquidity of the Company (2 points) Exercise 3(10 points) The

please solve only question 3 , 4 and 5

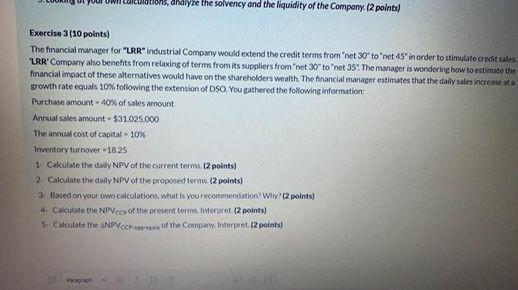

chilotions, andiyze the solvency and the liquidity of the Company (2 points) Exercise 3(10 points) The financial manager for "LRR industrial Company would extend the credit terms from net 30 to net 45' in order to stimulate credit sales "LRR' Company also benefits from relaxing of terms from its suppliers from net 30"to"net 35. The manager is wondering how to estimate the financial impact of these alternatives would have on the shareholders wealth. The financial manager estimates that the daily sales increase ata growth rate equals 10% following the extension of DSO You gathered the following information: Purchase amount -40% of sales amount Annual sales amount - $31.025.000 The annual cost of capital -10% Inventory turnover -18 25 1- Calculate the call NPV of the current term. (2 points) 2. Calculate the daily NPV of the proposed terms (2 points) 3. Based on your own calculations. What is you recommendation? Why? (2 points) 4. Calculate the NPV of the present terms. Interpret (2 points 5. Calculatot PVCf the Company. Interpret (2 points) chilotions, andiyze the solvency and the liquidity of the Company (2 points) Exercise 3(10 points) The financial manager for "LRR industrial Company would extend the credit terms from net 30 to net 45' in order to stimulate credit sales "LRR' Company also benefits from relaxing of terms from its suppliers from net 30"to"net 35. The manager is wondering how to estimate the financial impact of these alternatives would have on the shareholders wealth. The financial manager estimates that the daily sales increase ata growth rate equals 10% following the extension of DSO You gathered the following information: Purchase amount -40% of sales amount Annual sales amount - $31.025.000 The annual cost of capital -10% Inventory turnover -18 25 1- Calculate the call NPV of the current term. (2 points) 2. Calculate the daily NPV of the proposed terms (2 points) 3. Based on your own calculations. What is you recommendation? Why? (2 points) 4. Calculate the NPV of the present terms. Interpret (2 points 5. Calculatot PVCf the Company. Interpret (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts