Question: Please solve only question 3 and in detail, stepwise even the most basic steps! (e) What are the 1-year forward rate in 2 years and

Please solve only question 3 and in detail, stepwise even the most basic steps!

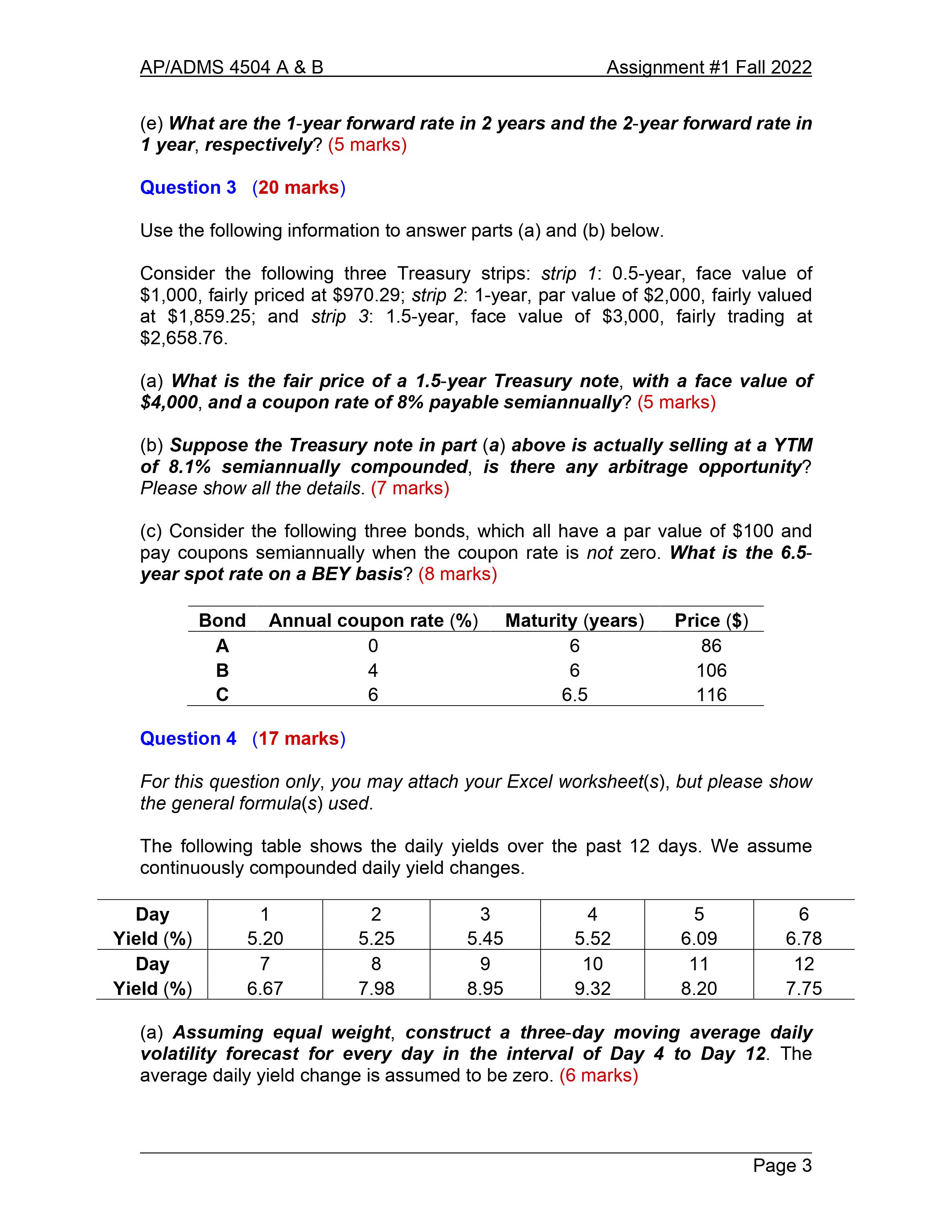

(e) What are the 1-year forward rate in 2 years and the 2-year forward rate in 1 year, respectively? (5 marks) Question 3 (20 marks) Use the following information to answer parts (a) and (b) below. Consider the following three Treasury strips: strip 1: 0.5-year, face value of $1,000, fairly priced at $970.29; strip 2: 1-year, par value of $2,000, fairly valued at $1,859.25; and strip 3: 1.5-year, face value of $3,000, fairly trading at $2,658.76. (a) What is the fair price of a 1.5-year Treasury note, with a face value of $4,000, and a coupon rate of 8% payable semiannually? (5 marks) (b) Suppose the Treasury note in part (a) above is actually selling at a YTM of 8.1% semiannually compounded, is there any arbitrage opportunity? Please show all the details. (7 marks) (c) Consider the following three bonds, which all have a par value of $100 and pay coupons semiannually when the coupon rate is not zero. What is the 6.5year spot rate on a BEY basis? (8 marks) Question 4 (17 marks) For this question only, you may attach your Excel worksheet(s), but please show the general formula(s) used. The following table shows the daily yields over the past 12 days. We assume continuously compounded daily yield changes. (a) Assuming equal weight, construct a three-day moving average daily volatility forecast for every day in the interval of Day 4 to Day 12 . The average daily yield change is assumed to be zero. (6 marks) (e) What are the 1-year forward rate in 2 years and the 2-year forward rate in 1 year, respectively? (5 marks) Question 3 (20 marks) Use the following information to answer parts (a) and (b) below. Consider the following three Treasury strips: strip 1: 0.5-year, face value of $1,000, fairly priced at $970.29; strip 2: 1-year, par value of $2,000, fairly valued at $1,859.25; and strip 3: 1.5-year, face value of $3,000, fairly trading at $2,658.76. (a) What is the fair price of a 1.5-year Treasury note, with a face value of $4,000, and a coupon rate of 8% payable semiannually? (5 marks) (b) Suppose the Treasury note in part (a) above is actually selling at a YTM of 8.1% semiannually compounded, is there any arbitrage opportunity? Please show all the details. (7 marks) (c) Consider the following three bonds, which all have a par value of $100 and pay coupons semiannually when the coupon rate is not zero. What is the 6.5year spot rate on a BEY basis? (8 marks) Question 4 (17 marks) For this question only, you may attach your Excel worksheet(s), but please show the general formula(s) used. The following table shows the daily yields over the past 12 days. We assume continuously compounded daily yield changes. (a) Assuming equal weight, construct a three-day moving average daily volatility forecast for every day in the interval of Day 4 to Day 12 . The average daily yield change is assumed to be zero. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts