Question: *** please solve part 2 and show work Intro A GM and a Ford bond both have 4 years to maturity, a $1,000 par value,

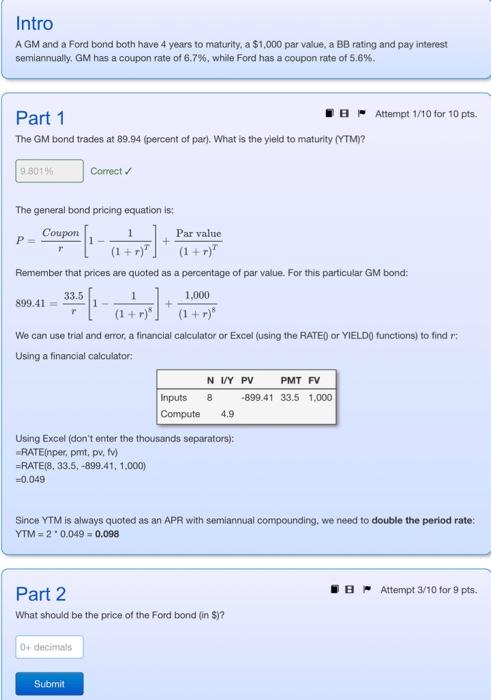

Intro A GM and a Ford bond both have 4 years to maturity, a $1,000 par value, a BB rating and pay interest semiannually, GM has a coupon rate of 6.7%, while Ford has a coupon rate of 5.6%. Part 1 - A Attempt 1/10 for 10 pts. The GM bond trades at 89.94 (percent of par). What is the yleld to maturity (rTM)? Correct The general bond pricing equation is: P=rCoupon[1(1+r)T1]+(1+r)TParvalue Remember that prices are quoted as a percentage of par value. For this particular GM bond: 899.41=r33.5[1(1+r)81]+(1+r)81,000 We can use trial and error, a financial calculator or Excel (using the RATEO or YIELDO functions) to find r : Using a financial calculator: Using Excel (don't enter the thousands separators): -RATE(nper, pmt, pv, fv) = RATE (8,33.5,899.41,1,000) =0.049 Since YTM is always quoted as an APR with semiannual compounding. we need to double the period rate: YTM=20.049=0.098 Part 2 - Attempt 3/10 for 9 pts. What should be the price of the Ford bond (in \$)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts