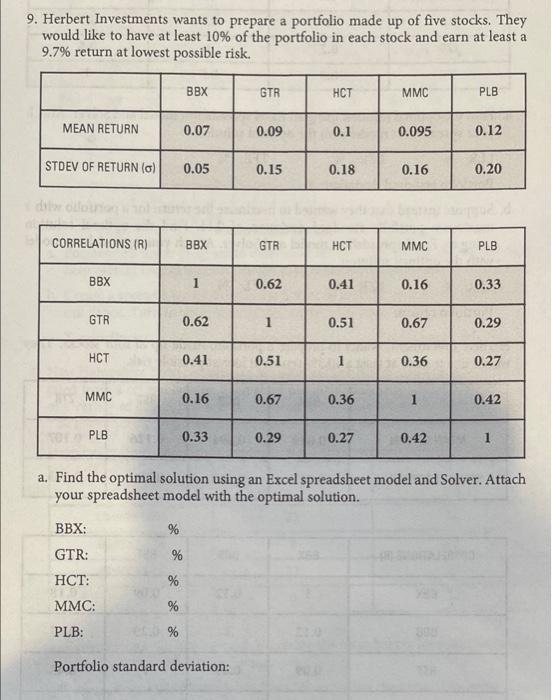

Question: Please solve part a with spreadsheet model 9. Herbert Investments wants to prepare a portfolio made up of five stocks. They would like to have

9. Herbert Investments wants to prepare a portfolio made up of five stocks. They would like to have at least 10% of the portfolio in each stock and earn at least a 9.7% return at lowest possible risk. BBX GTR HCT MMC PLB MEAN RETURN 0.07 0.09 0.1 0.095 0.12 STDEV OF RETURN (O) 0.05 0.15 0.18 0.16 0.20 CORRELATIONS (R) BBX GTR HCT MMC PLB BBX 0.62 0.41 0.16 0.33 GTR 0.62 1 0.51 0.67 0.29 HCT 0.41 0.51 1 0.36 0.27 MMC 0.16 0.67 0.36 1 0.42 PLB 0.33 0.29 0.27 0.42 1 a. Find the optimal solution using an Excel spreadsheet model and Solver. Attach your spreadsheet model with the optimal solution. % BBX: GTR: % HCT: % MMC: % PLB: % Portfolio standard deviation: 9. Herbert Investments wants to prepare a portfolio made up of five stocks. They would like to have at least 10% of the portfolio in each stock and earn at least a 9.7% return at lowest possible risk. BBX GTR HCT MMC PLB MEAN RETURN 0.07 0.09 0.1 0.095 0.12 STDEV OF RETURN (O) 0.05 0.15 0.18 0.16 0.20 CORRELATIONS (R) BBX GTR HCT MMC PLB BBX 0.62 0.41 0.16 0.33 GTR 0.62 1 0.51 0.67 0.29 HCT 0.41 0.51 1 0.36 0.27 MMC 0.16 0.67 0.36 1 0.42 PLB 0.33 0.29 0.27 0.42 1 a. Find the optimal solution using an Excel spreadsheet model and Solver. Attach your spreadsheet model with the optimal solution. % BBX: GTR: % HCT: % MMC: % PLB: % Portfolio standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts